Expansion of E-commerce Channels

The expansion of e-commerce channels is reshaping the Frozen Bakery Additives Market. With the rise of online grocery shopping, consumers now have greater access to a variety of frozen bakery products, which often utilize specialized additives for improved quality. This shift has led to an increase in demand for frozen bakery items, as consumers can conveniently purchase them from the comfort of their homes. Data suggests that online grocery sales are expected to grow by over 20% annually, indicating a substantial opportunity for manufacturers to leverage e-commerce platforms. Consequently, the focus on developing appealing frozen bakery additives that cater to this growing market segment is becoming increasingly critical.

Rising Demand for Convenience Foods

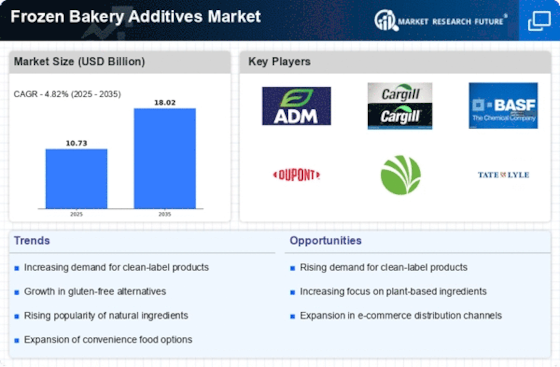

The increasing consumer preference for convenience foods is a notable driver in the Frozen Bakery Additives Market. As lifestyles become busier, consumers are seeking quick meal solutions that do not compromise on quality. This trend has led to a surge in the demand for frozen bakery products, which often require additives to enhance texture, flavor, and shelf life. According to industry reports, the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. Consequently, manufacturers are focusing on developing innovative frozen bakery additives that cater to this demand, thereby propelling the market forward.

Increased Focus on Nutritional Value

The increased focus on nutritional value is a significant driver in the Frozen Bakery Additives Market. As consumers become more health-conscious, there is a growing demand for frozen bakery products that offer enhanced nutritional benefits. This trend has led manufacturers to explore the incorporation of functional additives, such as fiber and protein enhancers, into their products. Market analysis indicates that the functional food sector is expected to witness a growth rate of approximately 6% over the next few years. Consequently, the development of frozen bakery additives that contribute to the nutritional profile of products is becoming a strategic priority for manufacturers aiming to meet evolving consumer expectations.

Growing Interest in Clean Label Products

The trend towards clean label products is significantly influencing the Frozen Bakery Additives Market. Consumers are increasingly scrutinizing ingredient lists and favoring products that contain natural and recognizable components. This shift has prompted manufacturers to reformulate their frozen bakery offerings, incorporating clean label additives that align with consumer preferences. Research indicates that the clean label market is expected to reach a valuation of over 180 billion by 2025, suggesting a robust opportunity for frozen bakery additives that meet these criteria. As a result, companies are investing in research and development to create additives that are both effective and transparent, thus enhancing their market position.

Innovations in Food Preservation Techniques

Innovations in food preservation techniques are playing a pivotal role in the Frozen Bakery Additives Market. As consumers demand longer shelf life and better quality in frozen products, manufacturers are investing in advanced preservation methods. These innovations often involve the use of specialized additives that enhance the stability and freshness of frozen bakery items. The market for food preservatives is projected to grow at a rate of 5% annually, reflecting the increasing importance of these technologies. As a result, companies are likely to prioritize the development of cutting-edge frozen bakery additives that not only preserve but also enhance the overall sensory experience of the products.