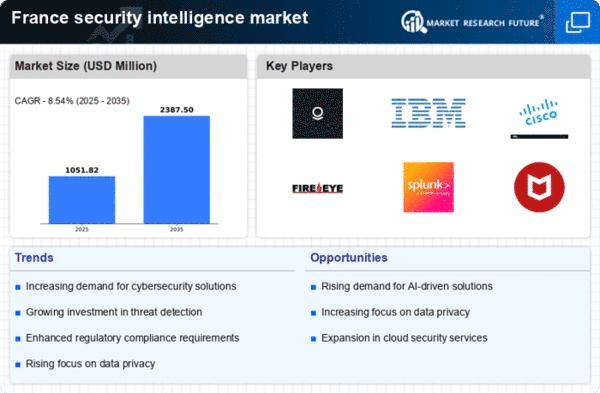

Rising Cyber Threats

The security intelligence market in France is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Recent reports indicate that cybercrime costs the French economy approximately €3.5 billion annually, prompting organizations to invest heavily in security intelligence solutions. This trend is likely to continue as businesses recognize the necessity of proactive measures to safeguard sensitive data. The rise in ransomware attacks and data breaches has led to a heightened awareness of the importance of security intelligence, driving growth in this market. As companies seek to mitigate risks, the adoption of advanced security intelligence tools is expected to rise, further solidifying the market's position in the technology landscape.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the security intelligence market in France. The integration of innovative technologies such as artificial intelligence, machine learning, and big data analytics is enhancing the capabilities of security intelligence solutions. These advancements enable organizations to analyze vast amounts of data in real-time, improving threat detection and response times. As businesses increasingly rely on technology to safeguard their operations, the demand for sophisticated security intelligence tools is likely to rise. The market is expected to witness a shift towards more automated and intelligent security solutions, reflecting the evolving landscape of cyber threats and the need for proactive defense mechanisms.

Increased Regulatory Scrutiny

The security intelligence market in France is influenced by the growing regulatory scrutiny surrounding data protection and privacy. With the implementation of the General Data Protection Regulation (GDPR), organizations are compelled to adopt robust security measures to ensure compliance. Non-compliance can result in fines reaching up to €20 million or 4% of annual global turnover, which underscores the urgency for businesses to invest in security intelligence solutions. This regulatory environment is likely to drive demand for advanced security intelligence tools that assist organizations in monitoring and managing compliance effectively. As companies navigate the complexities of regulatory requirements, the security intelligence market is expected to benefit from increased investments in compliance-related technologies.

Government Initiatives and Funding

The French government is actively promoting the development of the security intelligence market through various initiatives and funding programs. In recent years, the government has allocated substantial resources to enhance national cybersecurity capabilities, with an investment of over €1 billion aimed at bolstering the security infrastructure. This support is likely to stimulate innovation and growth within the security intelligence market, as companies leverage government funding to develop cutting-edge solutions. Furthermore, the establishment of public-private partnerships is expected to foster collaboration, enhancing the overall effectiveness of security measures across sectors. As a result, the security intelligence market is poised for significant expansion in response to these governmental efforts.

Growing Awareness of Cybersecurity

There is a notable increase in awareness regarding cybersecurity among organizations in France, which is significantly impacting the security intelligence market. As high-profile data breaches and cyber incidents make headlines, businesses are becoming more cognizant of the potential risks associated with inadequate security measures. This heightened awareness is driving organizations to prioritize investments in security intelligence solutions to protect their assets and reputation. Surveys indicate that approximately 70% of French companies plan to increase their cybersecurity budgets in the coming years, reflecting a commitment to enhancing their security posture. Consequently, the security intelligence market is likely to experience robust growth as organizations seek to implement comprehensive security strategies.