Rising Cancer Incidence

The increasing incidence of cancer in France is a primary driver for the liquid biopsy market. According to recent statistics, cancer cases are projected to rise by approximately 2.5% annually, leading to a heightened demand for innovative diagnostic solutions. Liquid biopsy offers a non-invasive alternative to traditional tissue biopsies, enabling early detection and monitoring of cancer progression. This shift towards less invasive procedures aligns with patient preferences and healthcare provider practices. The liquid biopsy market is thus positioned to benefit from this trend, as healthcare systems seek efficient and effective diagnostic tools to manage the growing cancer burden. Furthermore, the potential for liquid biopsies to provide real-time insights into tumor dynamics may enhance treatment personalization, further driving market growth.

Technological Innovations

Technological advancements in the liquid biopsy market are transforming cancer diagnostics in France. Innovations such as next-generation sequencing (NGS) and digital PCR are enhancing the sensitivity and specificity of liquid biopsies. These technologies enable the detection of circulating tumor DNA (ctDNA) and other biomarkers with unprecedented accuracy. As a result, the market is witnessing a surge in product offerings that leverage these cutting-edge technologies. The French healthcare sector is increasingly adopting these innovations, with a projected market growth rate of around 15% over the next five years. This rapid evolution in technology not only improves diagnostic capabilities but also fosters collaborations between biotech firms and research institutions, further propelling the liquid biopsy market forward.

Regulatory Framework Enhancements

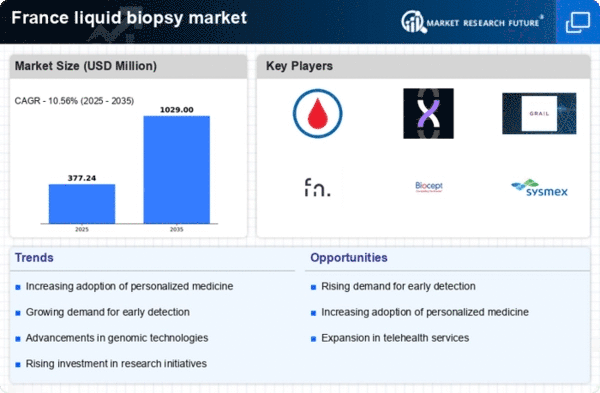

The regulatory landscape for the liquid biopsy market in France is evolving, with enhancements aimed at facilitating the approval and commercialization of new diagnostic tests. Recent initiatives by regulatory bodies are streamlining the process for liquid biopsy products, potentially reducing time-to-market for innovative solutions. This supportive regulatory environment is likely to encourage investment and innovation within the sector. As a result, the liquid biopsy market may witness an influx of new entrants and products, contributing to increased competition and diversity in offerings. Analysts predict that these regulatory enhancements could lead to a market expansion of approximately 10% annually, as more liquid biopsy tests gain approval and become available to healthcare providers and patients.

Growing Demand for Non-Invasive Procedures

The liquid biopsy market is experiencing a significant shift towards non-invasive diagnostic methods. Patients and healthcare providers in France are increasingly favoring procedures that minimize discomfort and risk. Liquid biopsies, which utilize blood samples to detect cancer-related biomarkers, align perfectly with this demand. The convenience and safety associated with liquid biopsies are likely to drive their adoption in clinical settings. Market analysts estimate that the non-invasive diagnostic segment could account for over 60% of the total liquid biopsy market by 2027. This trend reflects a broader movement within the healthcare landscape, where patient-centric approaches are becoming paramount. As the liquid biopsy market continues to evolve, the emphasis on non-invasive techniques will likely remain a key driver of growth.

Increased Investment in Research and Development

Investment in research and development (R&D) within the liquid biopsy market is on the rise in France. Both public and private sectors are recognizing the potential of liquid biopsies to revolutionize cancer diagnostics. Funding for R&D initiatives is expected to increase by approximately 20% over the next few years, facilitating the development of novel liquid biopsy technologies and applications. This influx of capital is likely to accelerate innovation, leading to the introduction of more sophisticated diagnostic tools. Furthermore, collaborations between academic institutions and industry players are becoming more prevalent, fostering an environment conducive to breakthroughs in liquid biopsy methodologies. As a result, the liquid biopsy market is poised for substantial growth, driven by a robust pipeline of innovative solutions.