Investment in Healthcare Infrastructure

France's commitment to enhancing its healthcare infrastructure significantly influences the embolic protection-devices market. The government has allocated substantial funding to modernize hospitals and medical facilities, which includes the procurement of advanced medical technologies. This investment is projected to reach €10 billion by 2026, focusing on improving surgical capabilities and patient care. As hospitals upgrade their equipment, the adoption of embolic protection devices is likely to increase, driven by the need for safer surgical procedures. Additionally, the integration of these devices into standard surgical protocols may become more prevalent, further stimulating market growth. The emphasis on high-quality healthcare services aligns with the objectives of the embolic protection-devices market, indicating a favorable environment for innovation and expansion.

Focus on Patient Safety and Quality of Care

The increasing emphasis on patient safety and quality of care in France is a crucial driver for the embolic protection-devices market. Healthcare providers are under pressure to minimize complications during surgical procedures, leading to a heightened interest in technologies that enhance patient outcomes. Regulatory bodies and healthcare organizations are advocating for the adoption of best practices that include the use of embolic protection devices. This focus on safety is reflected in the growing number of clinical guidelines recommending these devices for specific procedures. As hospitals strive to meet these standards, the demand for embolic protection devices is expected to rise. The alignment of patient safety initiatives with the objectives of the embolic protection-devices market indicates a favorable trajectory for growth and innovation.

Rising Incidence of Cardiovascular Diseases

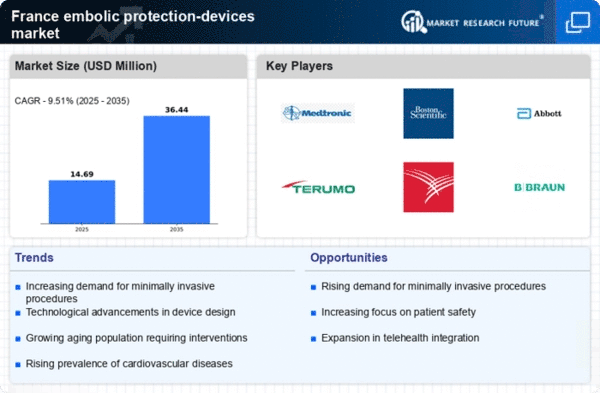

The increasing prevalence of cardiovascular diseases in France is a primary driver for the embolic protection-devices market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced medical interventions, including embolic protection devices, to mitigate risks during procedures such as cardiac surgeries and interventions. As healthcare providers seek to enhance patient outcomes, the demand for these devices is expected to rise. Furthermore, the French healthcare system is increasingly prioritizing innovative solutions to improve surgical safety, which further propels the growth of the embolic protection-devices market. The combination of a growing patient population and the need for effective treatment options suggests a robust market potential in the coming years.

Technological Innovations and Product Development

Technological innovations play a pivotal role in shaping the embolic protection-devices market. Continuous advancements in materials and design are leading to the development of more effective and user-friendly devices. French manufacturers are increasingly investing in research and development to create next-generation embolic protection devices that offer improved performance and safety profiles. The market is witnessing the introduction of devices that are not only more efficient but also easier to integrate into existing surgical workflows. This trend is likely to attract more healthcare providers to adopt these technologies, thereby expanding the market. Furthermore, collaborations between medical device companies and research institutions are fostering innovation, suggesting a dynamic environment for the embolic protection-devices market in France.

Aging Population and Increased Surgical Procedures

The demographic shift towards an aging population in France is a significant driver for the embolic protection-devices market. As individuals age, the likelihood of requiring surgical interventions, particularly cardiovascular procedures, increases. Projections indicate that by 2030, over 20% of the French population will be aged 65 and older, leading to a higher demand for surgical solutions. This demographic trend is likely to result in a corresponding rise in the utilization of embolic protection devices during surgeries to prevent complications. Furthermore, the growing acceptance of minimally invasive procedures among older patients may enhance the market's appeal, as these devices are often integral to such interventions. The intersection of an aging population and the need for advanced surgical tools suggests a promising outlook for the embolic protection-devices market.