Rising Security Concerns

The biometric atm market in France is experiencing growth driven by escalating security concerns among consumers and financial institutions. With increasing incidents of fraud and identity theft, banks are seeking advanced solutions to protect their customers. Biometric authentication methods, such as fingerprint and facial recognition, offer enhanced security features that traditional PIN-based systems cannot match. According to recent data, the adoption of biometric systems in ATMs has been linked to a 30% reduction in fraudulent transactions. This trend indicates a strong demand for secure banking solutions, positioning the biometric atm market as a critical component in the fight against financial crime.

Consumer Demand for Convenience

In France, the biometric atm market is significantly influenced by consumer demand for convenience and speed in banking transactions. As customers seek quicker and more efficient ways to access their funds, biometric ATMs provide a seamless experience that eliminates the need for remembering complex PINs. This shift in consumer behavior is evident, as studies show that 70% of users prefer biometric authentication over traditional methods. The convenience factor is likely to drive further adoption of biometric systems in ATMs, suggesting a promising trajectory for the biometric atm market as banks strive to meet evolving customer expectations.

Regulatory Compliance and Standards

The biometric atm market in France is also shaped by the need for compliance with regulatory standards aimed at enhancing security in financial transactions. Regulatory bodies are increasingly mandating the implementation of biometric solutions to safeguard customer data and prevent fraud. This regulatory push is encouraging banks to adopt biometric ATMs as part of their compliance strategies. As a result, the market is witnessing a surge in investments in biometric technologies, with projections indicating a potential market value of €500 million by 2030. This regulatory environment is likely to foster growth in the biometric atm market, as institutions align their operations with legal requirements.

Technological Advancements in Biometrics

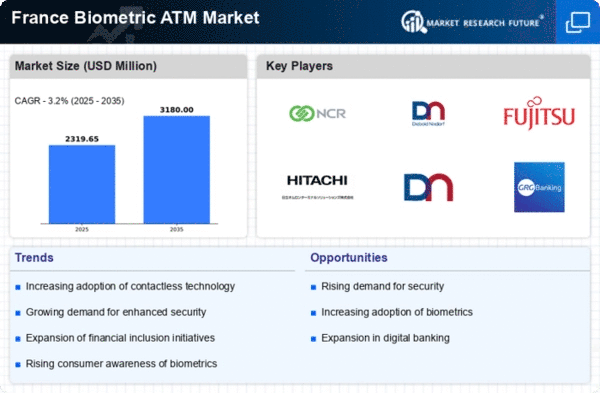

Technological innovations are propelling the biometric atm market forward in France. The development of sophisticated biometric algorithms and hardware has made it feasible to implement reliable and efficient biometric systems in ATMs. For instance, advancements in artificial intelligence and machine learning are enhancing the accuracy of biometric recognition, thereby improving user experience. The market is projected to grow at a CAGR of 15% over the next five years, driven by these technological advancements. As banks invest in modernizing their ATM networks, the integration of biometric solutions is becoming increasingly prevalent, indicating a robust future for the biometric atm market.

Competitive Pressure Among Financial Institutions

The competitive landscape among financial institutions in France is a driving force behind the growth of the biometric atm market. Banks are striving to differentiate themselves by offering innovative services that enhance customer satisfaction and loyalty. The integration of biometric technology into ATMs is seen as a strategic move to attract tech-savvy customers who prioritize security and convenience. As competition intensifies, financial institutions are likely to invest more in biometric solutions, potentially leading to a market expansion. This competitive pressure is indicative of a dynamic environment where the biometric atm market is poised for significant growth as banks seek to maintain their market positions.