Rising Demand for Secure Transactions

The biometric atm market in Japan is experiencing a notable surge in demand for secure transaction methods. As financial institutions and consumers alike prioritize security, the adoption of biometric authentication technologies is becoming increasingly prevalent. In 2025, it is estimated that the market for biometric ATMs will grow by approximately 15%, driven by the need to mitigate fraud and enhance user trust. This trend is particularly pronounced in urban areas, where the concentration of financial activities necessitates robust security measures. The biometric atm market is thus positioned to benefit from this heightened focus on security, as banks and service providers invest in advanced biometric solutions to safeguard customer transactions.

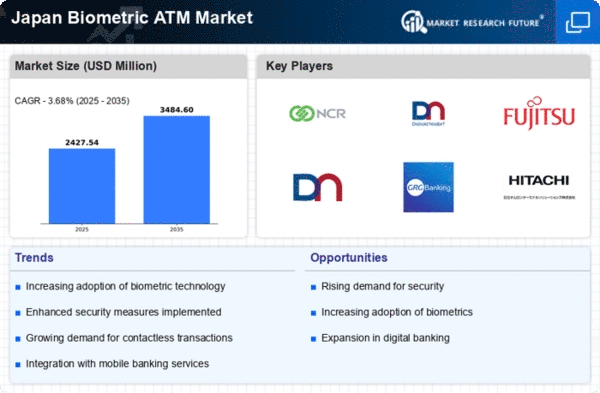

Competitive Landscape and Market Dynamics

The competitive landscape of the biometric atm market in Japan is evolving, with numerous players vying for market share. This dynamic environment is fostering innovation and driving advancements in biometric technologies. As companies strive to differentiate their offerings, the biometric atm market is likely to witness an influx of new products and services. By 2025, the market is expected to grow by around 11%, as established banks and emerging fintech companies invest in biometric solutions to enhance their service portfolios. This competition not only benefits consumers through improved options but also accelerates the overall growth of the biometric atm market.

Technological Advancements in Biometric Systems

Technological innovations are playing a pivotal role in shaping the biometric atm market in Japan. The integration of advanced biometric systems, such as facial recognition and fingerprint scanning, is enhancing the efficiency and accuracy of ATM transactions. In recent years, the market has seen a shift towards multi-modal biometric systems, which combine various authentication methods to improve security and user experience. By 2025, the biometric atm market is projected to witness a growth rate of around 12%, as financial institutions increasingly adopt these cutting-edge technologies. This trend not only streamlines the transaction process but also addresses the growing concerns regarding identity theft and unauthorized access.

Government Initiatives Promoting Biometric Adoption

The Japanese government is actively promoting the adoption of biometric technologies across various sectors, including banking. Initiatives aimed at enhancing digital security and financial inclusion are likely to bolster the biometric atm market. In 2025, government policies may facilitate the integration of biometric systems in ATMs, potentially leading to a market growth of 10%. These initiatives are designed to encourage financial institutions to invest in biometric solutions, thereby improving customer access to secure banking services. The biometric atm market stands to gain from these supportive measures, as they create a conducive environment for innovation and investment in biometric technologies.

Consumer Preference for Convenient Banking Solutions

Consumer behavior is shifting towards a preference for convenient and efficient banking solutions, which is significantly impacting the biometric atm market in Japan. As customers seek faster and more user-friendly transaction methods, biometric ATMs are emerging as a preferred choice. The biometric atm market is likely to see an increase in adoption rates, with projections indicating a growth of approximately 14% by 2025. This trend is particularly relevant among younger demographics, who are more inclined to embrace technology-driven solutions. Financial institutions are responding to this demand by enhancing their ATM offerings with biometric capabilities, thereby aligning with consumer expectations for convenience and speed.