Rising Demand for Secure Transactions

The biometric ATM market in Europe is experiencing a notable surge in demand for secure transaction methods. As financial institutions prioritize customer safety, the integration of biometric technologies such as fingerprint and facial recognition is becoming increasingly prevalent. This shift is driven by a growing awareness of fraud and identity theft, which has prompted banks to invest in advanced security measures. According to recent data, the adoption of biometric ATMs is projected to increase by approximately 25% over the next five years. This trend indicates a robust growth trajectory for the biometric ATM market, as consumers seek more secure and convenient banking options.

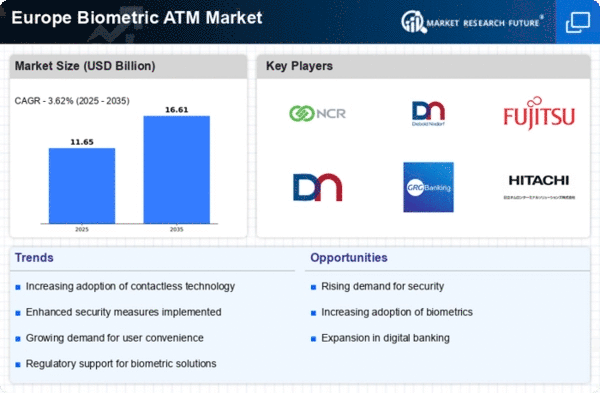

Competitive Landscape and Market Dynamics

The competitive landscape of the biometric ATM market in Europe is evolving, with numerous players vying for market share. Established financial institutions are increasingly collaborating with technology providers to enhance their ATM offerings. This collaboration is fostering innovation and driving the development of new biometric solutions tailored to meet consumer needs. Additionally, the entry of new players into the market is intensifying competition, leading to more diverse product offerings. As a result, the biometric ATM market is expected to witness a compound annual growth rate (CAGR) of around 20% over the next few years, reflecting the dynamic nature of this sector.

Regulatory Support for Biometric Solutions

Regulatory frameworks in Europe are increasingly supportive of biometric solutions, which is positively impacting the biometric ATM market. Governments and regulatory bodies are recognizing the need for enhanced security measures in financial transactions. Initiatives aimed at promoting the use of biometric identification are being implemented, which encourages banks to adopt these technologies. For instance, the European Union's General Data Protection Regulation (GDPR) has set guidelines that facilitate the secure use of biometric data. This regulatory support is expected to bolster the biometric ATM market, as compliance with these regulations becomes a priority for financial institutions.

Consumer Preference for Contactless Banking

Consumer preferences are shifting towards contactless banking solutions, which is influencing the biometric ATM market in Europe. The convenience and speed offered by biometric ATMs align with the growing demand for seamless banking experiences. As more consumers opt for contactless transactions, banks are compelled to enhance their ATM offerings to meet these expectations. Recent surveys indicate that approximately 60% of consumers prefer using biometric methods for authentication over traditional PINs. This consumer inclination is likely to drive the adoption of biometric ATMs, thereby propelling the growth of the biometric ATM market in the region.

Technological Advancements in Biometric Systems

Technological advancements play a pivotal role in shaping the biometric ATM market in Europe. Innovations in biometric recognition technologies, such as improved algorithms and enhanced sensor capabilities, are making these systems more reliable and efficient. The market is witnessing a shift towards multi-modal biometric systems that combine various recognition methods, thereby increasing accuracy and user satisfaction. As a result, financial institutions are more inclined to adopt these advanced systems, which are expected to account for over 40% of new ATM installations by 2026. This evolution in technology is likely to drive the growth of the biometric ATM market significantly.