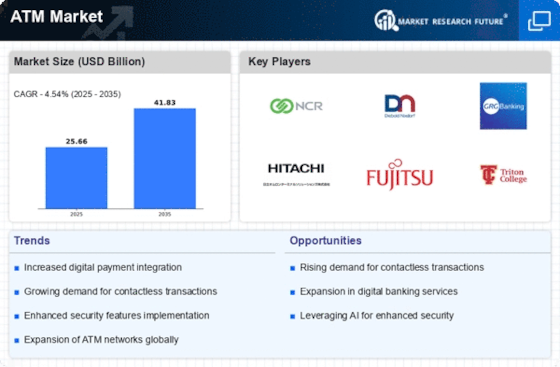

Emergence of Digital Banking Solutions

The emergence of digital banking solutions is reshaping the ATM Market. As consumers increasingly adopt online and mobile banking, the role of ATMs is evolving. While digital banking offers convenience, ATMs remain essential for cash access and certain transactions. Data suggests that despite the rise of digital banking, a significant percentage of consumers still prefer using ATMs for cash withdrawals and deposits. This duality indicates that ATMs will continue to coexist with digital solutions, potentially leading to a hybrid model of banking services. Financial institutions are likely to leverage this trend by integrating digital features into ATMs, such as mobile app connectivity and enhanced transaction capabilities. This evolution may ultimately strengthen the ATM Market by attracting a broader customer base.

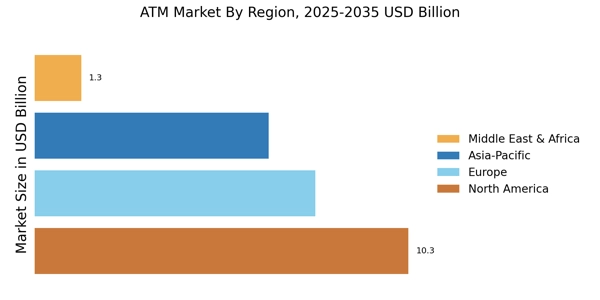

Increased Focus on Financial Inclusion

The ATM Market is witnessing a heightened focus on financial inclusion, particularly in developing regions. Governments and financial institutions are recognizing the importance of providing access to banking services for unbanked populations. The deployment of ATMs in remote and underserved areas is a strategic initiative aimed at bridging the financial gap. Recent statistics indicate that regions with increased ATM Market penetration have seen a rise in banking activity, with more individuals gaining access to essential financial services. This trend not only supports economic development but also enhances the overall growth of the ATM industry. As financial inclusion initiatives continue to expand, the demand for ATMs is likely to increase, fostering a more inclusive financial ecosystem.

Rising Demand for Cash Withdrawal Services

The ATM Market is experiencing a notable increase in demand for cash withdrawal services. As consumers continue to prefer cash transactions for various purchases, the number of ATM Market transactions is projected to rise. According to recent data, cash withdrawals account for a substantial portion of ATM Market usage, with estimates suggesting that over 60% of all ATM Market transactions are for cash withdrawals. This trend indicates a sustained reliance on ATMs for accessing cash, which is crucial for both urban and rural populations. Furthermore, the proliferation of ATMs in underserved areas is likely to enhance accessibility, thereby driving further growth in the ATM Market. Financial institutions are responding by expanding their ATM Market networks, which may lead to increased competition and innovation in service offerings.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements are significantly influencing the ATM Market. Financial institutions are compelled to adhere to stringent regulations regarding security, anti-money laundering, and consumer protection. These regulations often necessitate upgrades to ATM Market technology and infrastructure, which can drive investment in the sector. For example, compliance with the Payment Card Industry Data Security Standard (PCI DSS) requires ATMs to implement robust security measures, potentially increasing operational costs. However, these investments may also enhance consumer confidence in using ATMs, thereby driving usage. As regulatory frameworks evolve, the ATM industry must adapt, which could lead to both challenges and opportunities for growth in the coming years.

Technological Advancements in ATM Functionality

Technological advancements are playing a pivotal role in shaping the ATM industry. The integration of advanced features such as biometric authentication, artificial intelligence, and machine learning is enhancing the functionality of ATMs. These innovations not only improve security but also streamline user experience. For instance, ATMs equipped with biometric scanners can reduce fraud and enhance customer trust. Moreover, the implementation of AI-driven analytics allows financial institutions to optimize ATM Market placement and maintenance, potentially increasing operational efficiency. As these technologies become more prevalent, they are expected to attract more users to ATMs, thereby contributing to the growth of the ATM Market. The ongoing evolution of ATM Market technology suggests a promising future for both consumers and service providers.