Increased Focus on Patient-Centric Care

The emphasis on patient-centric care is reshaping the landscape of the Fractional Flow Reserve Market. Healthcare providers are increasingly prioritizing patient outcomes and satisfaction, leading to a greater demand for precise diagnostic tools that can guide treatment decisions. This shift is evident in the rising adoption of FFR measurements, which allow for tailored interventions based on individual patient needs. As a result, the market is witnessing a notable increase in the utilization of FFR technology, with estimates suggesting that the adoption rate could reach 60% in interventional cardiology practices by 2026. This trend underscores the importance of aligning medical technology with patient preferences, thereby driving growth in the Fractional Flow Reserve Market.

Technological Advancements in FFR Devices

The Fractional Flow Reserve Market is experiencing a surge in technological advancements, particularly in the development of innovative devices that enhance diagnostic accuracy. Recent innovations include the integration of advanced imaging techniques and real-time data analytics, which facilitate more precise measurements of coronary artery pressure. This evolution is likely to improve patient outcomes and streamline clinical workflows. The market for FFR devices is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by these technological enhancements. As healthcare providers increasingly adopt these advanced tools, the Fractional Flow Reserve Market is poised for substantial growth, reflecting a shift towards more effective and efficient cardiovascular care.

Rising Incidence of Cardiovascular Diseases

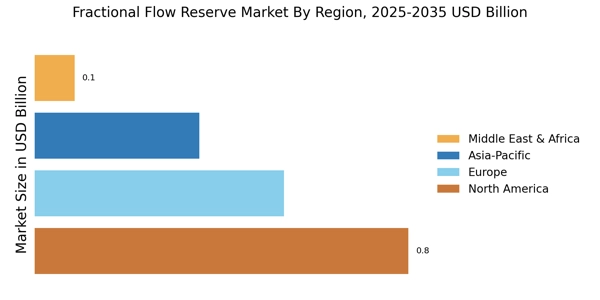

The escalating prevalence of cardiovascular diseases is a critical driver for the Fractional Flow Reserve Market. As the global population ages and lifestyle-related risk factors become more prevalent, the demand for effective diagnostic and treatment solutions is intensifying. Cardiovascular diseases remain a leading cause of morbidity and mortality, prompting healthcare systems to seek advanced technologies that can improve patient outcomes. The market for FFR is expected to expand significantly, with projections indicating a potential increase in market size to over 1 billion USD by 2028. This growth is largely attributed to the urgent need for accurate assessments of coronary artery disease, positioning the Fractional Flow Reserve Market as a vital component in the fight against cardiovascular ailments.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are playing a pivotal role in the growth of the Fractional Flow Reserve Market. Governments and health authorities are increasingly recognizing the value of FFR technology in improving patient outcomes and reducing healthcare costs. As a result, there has been a concerted effort to streamline the approval processes for new devices and ensure adequate reimbursement for FFR procedures. This supportive regulatory environment is likely to encourage more healthcare providers to adopt FFR technology, thereby expanding its market reach. Furthermore, studies indicate that hospitals utilizing FFR-guided interventions may experience a reduction in overall treatment costs, further incentivizing the adoption of this technology within the Fractional Flow Reserve Market.

Growing Awareness and Education Among Healthcare Professionals

The growing awareness and education among healthcare professionals regarding the benefits of FFR technology is significantly influencing the Fractional Flow Reserve Market. As more cardiologists and interventional specialists become educated about the advantages of using FFR for decision-making in coronary interventions, the adoption rates are expected to rise. Educational initiatives, including workshops and training programs, are being implemented to enhance understanding of FFR applications and its impact on patient care. This increased knowledge is likely to lead to a broader acceptance of FFR as a standard practice in cardiology, potentially increasing its market penetration. Consequently, the Fractional Flow Reserve Market stands to benefit from this trend, as more practitioners recognize the value of precise diagnostic tools in managing cardiovascular diseases.