Research Methodology on Blood Flow Measurement Devices Market

Background

This research focuses on several factors related to the Global Blood Flow Measurement Devices Market providing an in-depth assessment of the market. The report provides an insight into the industry and the latest trends impacting the market, with accurate data on the changing dynamics that are driving the Global Market. Market Research Future (MRFR) conducted an extensive market research study to understand the current Market scenario and forecast. A comprehensive analysis of the market through extensive secondary source research is conducted, followed by primary source interviews with industry professionals and key opinion leaders.

Objective

- To be aware of the size and scope of the Global Blood Flow Measurement Devices Market.

- To provide an in-depth analysis of the key dynamics impacting the Global Blood Flow Measurement Devices Market.

- To assess the competitive landscape in the Global Blood Flow Measurement Devices Market.

- To provide market forecasts with accurate industry estimates covering the years up to 2030.

Research Methodology

Market Research Future (MRFR) conducted an extensive market research study to understand the current and historic market scenario and forecast. A primary research source was carried out where key opinion leaders were interviewed. An exhaustive secondary research was conducted to gain insights into the overall market size and segmentation. Moreover, the report provides information concerning the changing environment due to current climate change issues.

Primary Source:

- Business leaders

- Manufacturers

- Distributors

- Industry Experts

- Procurement Managers

Secondary Sources

To gain further insights into the current market scenario, various secondary sources were consulted. In addition to journals and newspapers, primary sources also include certified industry databases, national government documents, websites, and technical internal systems, among others. Secondary research was used to better understand the details of the Global Blood Flow Measurement Devices Market.

Data Collection & Validation

The extensive secondary source research is followed by the primary source analysis for validating the secondary source data and gaining further insights into the market. The primary source analysis includes independent interviews with key opinion leaders such as CEOs and Directors, along with procurement professionals and sales teams. The primary interviews were conducted to validate and gain more insight into the secondary source data.

MARKET ESTIMATION:

The market figure is estimated using bottom-up and top-down approaches. The report analyzes the market size, estimated the ecosystem and forecasted future market size in terms of sales and application. The bottom-up approach is adopted to estimate the market size by taking the sum of all individual market sizes. To understand the size and dynamics of the Global Blood Flow Measurement Devices Market by application and by region, a top-down approach is followed. All of the figures provided in the report have been estimated through various primary and secondary sources and have been validated by the leading industry players.

Market Segmentation

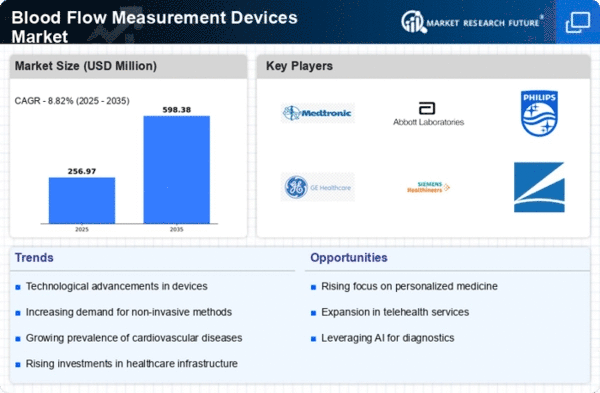

The market has been segmented on the basis of product type, application, and region. By product type, the Global Blood Flow Measurement Devices Market is segmented into blood flow meters, blood flow monitors, and others. The blood flow meters segment is further classified into ultrasound flow meters, Doppler flow meters, and other types of flow meters. By application, the market has been segmented into medical care, veterinary care, and research & development.

Regional Analysis

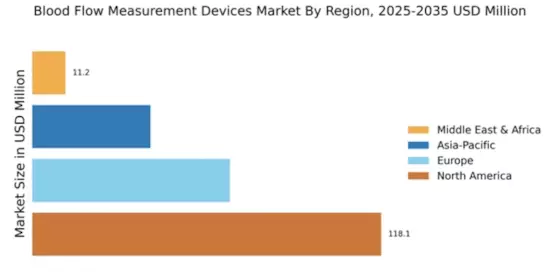

The report provides an analysis of the major countries in the Global Blood Flow Measurement Devices Market by region: North America, Europe, Asia-Pacific, and the Rest of the World. Furthermore, the report covers the key countries in each region. North America is the leading market in terms of revenue share and is expected to continue to dominate the market during the review period. Moreover, Europe is the second-largest market due to the growing demand for the advanced healthcare sector. Asia-Pacific is expected to witness the highest growth during the forecast period 2023 to 2030 due to the presence of a large population and a growing rate of awareness among the people.

Competitive Landscape

The report covers the analysis of the key market players and profiles: Koninklijke Philips N.V., Edwards Lifesciences Corporation, General Electric Company, Nihon Kohden Corporation, Compumedics, Ltd., Fresenius Medical Care AG & Co. KGaA, Deltex Medical Group, Optical Imaging Technologies, CardioFlowresearch, Technomed Europe S.p.A., and Tonometry Inc.

Conclusion

This report provides an in-depth analysis of the Global Blood Flow Measurement Devices Market providing an overview of current trends, competitive landscape and drivers, and market forecasts up to the year 2030. MRFR also conducts a market sizing exercise and offers exact numbers in terms of revenue shares and market size. The research methodology further includes primary source interviews with key opinion leaders. The report takes into account the contributions of major industry participants, market trends, and recent developments. The report provides market size estimations in terms of revenue and volumes, alongside regional segmentation and competitive analysis.