Rising Energy Demand

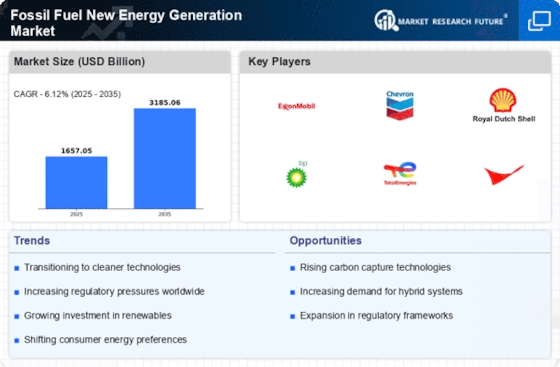

The increasing The Fossil Fuel New Energy Generation Industry. As populations grow and economies expand, the need for reliable energy sources intensifies. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This surge necessitates the continued reliance on fossil fuels, particularly in developing regions where alternative energy infrastructure is still in its infancy. The Fossil Fuel New Energy Generation Market is likely to benefit from this trend, as fossil fuels remain a dominant source of energy due to their established supply chains and technological advancements in extraction and processing. Consequently, the industry may experience significant growth as it adapts to meet the escalating energy needs of various sectors.

Global Economic Recovery

The ongoing The Fossil Fuel New Energy Generation Industry. As economies rebound, industrial activities and energy consumption are expected to increase, leading to a higher demand for fossil fuels. The International Energy Agency forecasts that global oil demand will rise significantly as transportation and manufacturing sectors recover. This resurgence in economic activity may lead to increased investments in fossil fuel exploration and production, further stimulating the market. Additionally, the recovery may prompt governments to prioritize energy security, reinforcing the role of fossil fuels in meeting energy needs. Consequently, the Fossil Fuel New Energy Generation Market is likely to experience growth as it adapts to the changing economic landscape and responds to the rising energy demands of recovering economies.

Technological Advancements

Technological advancements play a crucial role in shaping the Fossil Fuel New Energy Generation Market. Innovations in extraction techniques, such as hydraulic fracturing and horizontal drilling, have enhanced the efficiency and cost-effectiveness of fossil fuel production. These technologies have led to a notable increase in the availability of natural gas and oil, thereby influencing market dynamics. For instance, the United States has witnessed a dramatic rise in natural gas production, contributing to a shift in energy consumption patterns. Furthermore, advancements in carbon capture and storage technologies are addressing environmental concerns, allowing the industry to mitigate its carbon footprint. As these technologies continue to evolve, they are expected to bolster the Fossil Fuel New Energy Generation Market by improving operational efficiencies and reducing environmental impacts.

Investment in Infrastructure

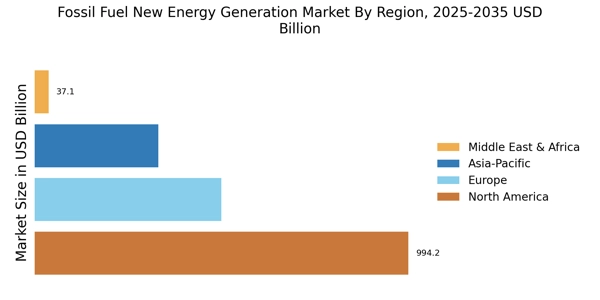

Investment in infrastructure is a vital driver for the Fossil Fuel New Energy Generation Market. As energy demands rise, the need for robust infrastructure to support fossil fuel extraction, transportation, and processing becomes increasingly apparent. Significant investments are being made in pipelines, refineries, and power plants to enhance the efficiency and reliability of fossil fuel supply chains. For instance, the construction of new pipelines in North America has facilitated the transportation of crude oil and natural gas, thereby expanding market access. Furthermore, investments in upgrading existing facilities to incorporate advanced technologies are expected to improve operational efficiencies. This influx of capital into infrastructure development is likely to bolster the Fossil Fuel New Energy Generation Market, ensuring that it remains competitive in an evolving energy landscape.

Policy and Regulatory Frameworks

The evolving policy and regulatory frameworks significantly impact the Fossil Fuel New Energy Generation Market. Governments worldwide are implementing policies aimed at energy security and sustainability, which often include support for fossil fuel projects. For example, certain countries have introduced incentives for fossil fuel exploration and production, recognizing the need for a balanced energy mix. Additionally, regulatory frameworks that promote cleaner fossil fuel technologies, such as natural gas over coal, are reshaping market dynamics. The International Energy Agency indicates that fossil fuels will still account for a substantial portion of the energy mix in the coming decades, suggesting that the Fossil Fuel New Energy Generation Market will continue to thrive under supportive regulatory environments. This interplay between policy and market dynamics is likely to influence investment decisions and operational strategies within the industry.