Rising Nutritional Awareness

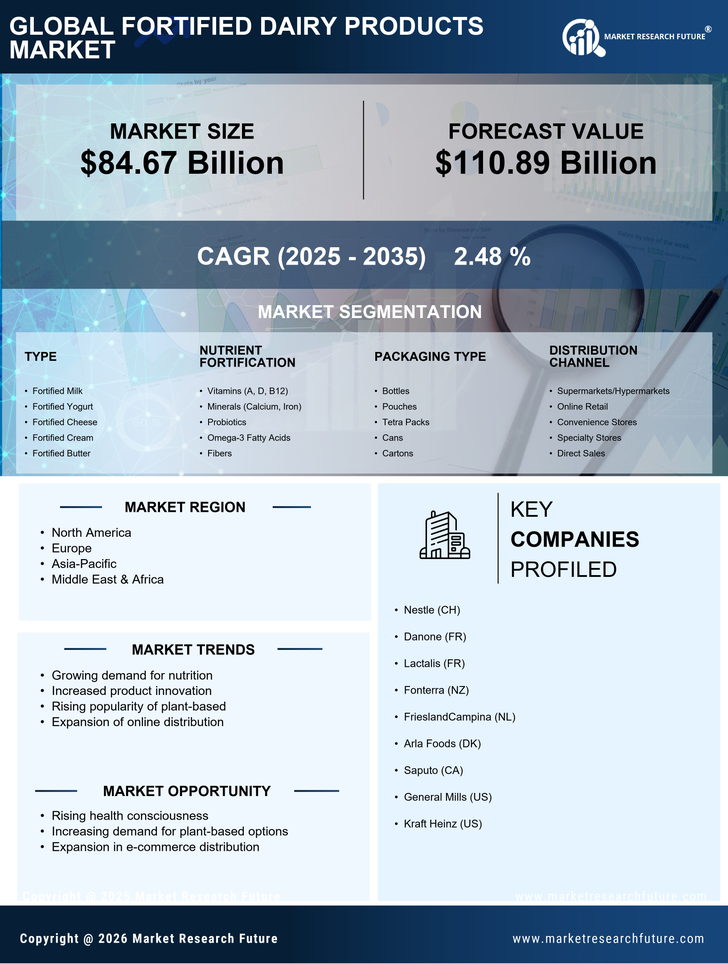

The increasing awareness regarding nutrition and health benefits is a primary driver for the Fortified dairy Products Market. Consumers are becoming more informed about the importance of vitamins and minerals in their diets. This trend is reflected in the growing demand for fortified dairy products, which are perceived as healthier alternatives to traditional dairy. According to recent data, the fortified dairy segment has seen a growth rate of approximately 6% annually, indicating a robust market response to health-oriented products. As consumers seek to enhance their nutritional intake, fortified dairy products are positioned favorably, appealing to health-conscious individuals and families. This shift in consumer behavior is likely to continue, further propelling the market forward.

Innovative Fortification Techniques

Advancements in fortification techniques are significantly influencing the Fortified Dairy Products Market. Manufacturers are increasingly adopting innovative methods to enhance the nutritional profile of dairy products, such as microencapsulation and the use of bioavailable nutrients. These techniques not only improve the efficacy of the added nutrients but also enhance the sensory attributes of the products, making them more appealing to consumers. As a result, the market is witnessing a diversification of fortified dairy offerings, including flavored yogurts and fortified milk alternatives. This innovation is expected to attract a broader consumer base, thereby expanding market reach and driving sales growth in the fortified dairy segment.

Increased Demand for Functional Foods

The Fortified Dairy Products Market is experiencing a surge in demand for functional foods, which are designed to provide health benefits beyond basic nutrition. This trend is driven by consumers seeking products that support specific health outcomes, such as improved immunity, digestive health, and bone strength. Fortified dairy products, enriched with probiotics, omega-3 fatty acids, and essential vitamins, are increasingly favored. Market data suggests that the functional food sector is projected to grow at a compound annual growth rate of 8% over the next five years. This growth indicates a strong consumer preference for products that offer added health benefits, positioning fortified dairy products as a key player in the functional food landscape.

Growing Urbanization and Lifestyle Changes

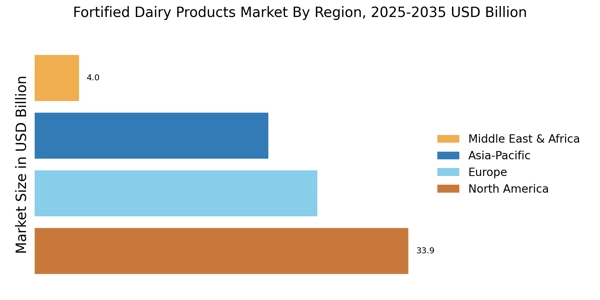

Urbanization and changing lifestyles are pivotal factors driving the Fortified Dairy Products Market. As urban populations grow, there is a noticeable shift in dietary patterns, with consumers increasingly favoring convenience and ready-to-eat products. Fortified dairy products, which offer both nutrition and convenience, are well-positioned to meet these evolving consumer needs. Data indicates that urban consumers are more likely to purchase fortified dairy items, contributing to a projected market growth of 5% in urban areas. This trend suggests that as more individuals lead busy lifestyles, the demand for fortified dairy products will likely continue to rise, further solidifying their market presence.

Regulatory Support for Nutritional Fortification

Regulatory frameworks supporting nutritional fortification are playing a crucial role in the Fortified Dairy Products Market. Governments and health organizations are increasingly advocating for the fortification of staple foods, including dairy products, to combat nutrient deficiencies in populations. This regulatory support not only encourages manufacturers to innovate but also enhances consumer trust in fortified products. Recent initiatives have led to the establishment of guidelines for fortification levels, ensuring safety and efficacy. As a result, the fortified dairy segment is expected to benefit from increased consumer acceptance and demand, potentially leading to a market expansion of 7% over the next few years.