Rising Demand in Electronics

The Fluoropolymers Market is experiencing a notable surge in demand driven by the electronics sector. Fluoropolymers Market are increasingly utilized in the manufacturing of high-performance components such as insulators, connectors, and circuit boards. The unique properties of fluoropolymers, including their excellent dielectric strength and thermal stability, make them ideal for these applications. According to recent data, the electronics segment is projected to account for a substantial share of the overall market, with a compound annual growth rate (CAGR) of approximately 6% over the next five years. This trend indicates a robust growth trajectory for the Fluoropolymers Market, as manufacturers seek materials that can withstand the rigors of modern electronic devices.

Expansion in Chemical Processing

The chemical processing industry is a significant driver for the Fluoropolymers Market, as these materials are essential for applications requiring high resistance to corrosive substances. Fluoropolymers Market are employed in linings, seals, and gaskets, where their durability and chemical inertness are paramount. The market for fluoropolymers in chemical processing is expected to grow at a CAGR of around 5% over the next few years, reflecting the increasing need for reliable materials in harsh environments. This expansion is indicative of a broader trend within the Fluoropolymers Market, where the demand for specialized materials continues to rise in response to evolving industry standards and safety regulations.

Growth in Automotive Applications

The automotive sector is increasingly adopting fluoropolymers, contributing significantly to the Fluoropolymers Market. These materials are favored for their chemical resistance, low friction properties, and ability to withstand extreme temperatures. Fluoropolymers Market are utilized in various automotive components, including fuel lines, gaskets, and seals. Recent estimates suggest that the automotive segment could represent around 20% of the total fluoropolymers market by 2026. This growth is largely attributed to the rising demand for lightweight and durable materials that enhance vehicle performance and fuel efficiency. As automotive manufacturers continue to innovate, the Fluoropolymers Market is likely to benefit from this trend.

Innovations in Coatings and Films

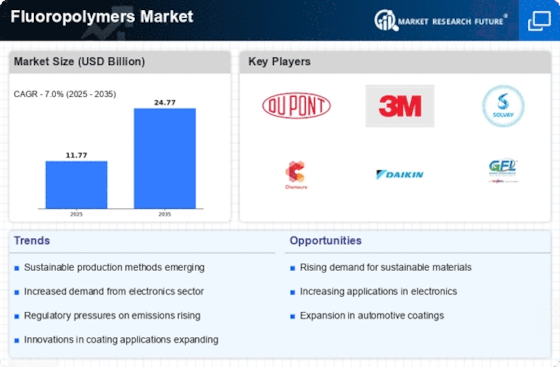

Innovative applications of fluoropolymers in coatings and films are propelling the Fluoropolymers Market forward. These materials are renowned for their non-stick properties, chemical resistance, and ability to withstand high temperatures, making them ideal for various coating applications. Industries such as food processing, pharmaceuticals, and aerospace are increasingly utilizing fluoropolymer coatings to enhance product performance and longevity. The coatings segment is projected to grow significantly, with estimates suggesting a CAGR of approximately 7% in the coming years. This growth reflects a broader trend within the Fluoropolymers Market, where advancements in material science are leading to the development of new, high-performance products.

Increasing Focus on Energy Efficiency

The push for energy efficiency across multiple sectors is driving the Fluoropolymers Market. Fluoropolymers Market are increasingly used in applications that require energy-efficient solutions, such as insulation materials in electrical and thermal applications. Their low thermal conductivity and high resistance to heat contribute to energy savings in various systems. Recent analyses indicate that the energy efficiency segment could see a growth rate of around 4% annually, as industries strive to meet regulatory standards and consumer demands for sustainable practices. This focus on energy efficiency is likely to bolster the Fluoropolymers Market, as companies seek to adopt materials that align with their sustainability goals.