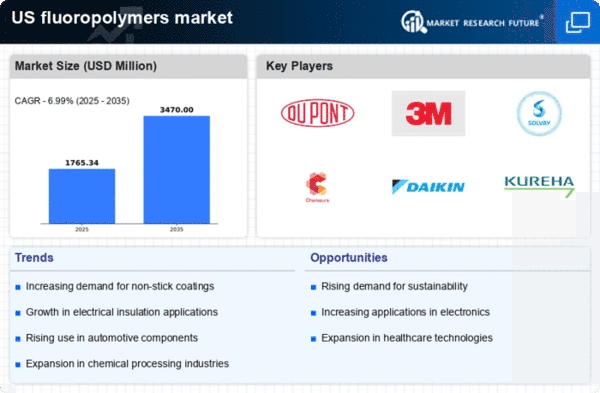

The fluoropolymers market exhibits a dynamic competitive landscape characterized by innovation and strategic positioning among key players. Major companies such as DuPont (US), 3M (US), and Chemours (US) are actively shaping the market through their focus on advanced materials and sustainable solutions. DuPont (US) emphasizes innovation in high-performance polymers, while 3M (US) leverages its extensive research capabilities to enhance product offerings. Chemours (US) is strategically positioned with a strong emphasis on sustainability, particularly in its production processes, which collectively influences the competitive environment by driving technological advancements and market responsiveness.Key business tactics within the fluoropolymers market include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like DuPont (US) and 3M (US) suggests a trend towards consolidation, as these firms seek to leverage their strengths to capture emerging opportunities in the sector.

In October DuPont (US) announced a significant investment in expanding its fluoropolymer production capabilities in the United States. This strategic move is likely aimed at meeting the growing demand for high-performance materials in various industries, including automotive and electronics. By enhancing its production capacity, DuPont (US) positions itself to better serve its customers and maintain a competitive edge in the market.

In September 3M (US) launched a new line of environmentally friendly fluoropolymer products designed to reduce environmental impact while maintaining performance standards. This initiative reflects 3M's commitment to sustainability and innovation, potentially attracting environmentally conscious customers and reinforcing its market position. The introduction of these products may also signal a shift in consumer preferences towards greener alternatives in the fluoropolymers market.

In August Chemours (US) entered into a strategic partnership with a leading automotive manufacturer to develop advanced fluoropolymer coatings for electric vehicles. This collaboration is indicative of Chemours' focus on innovation and its ability to adapt to evolving market demands. By aligning with a key player in the automotive sector, Chemours (US) enhances its visibility and relevance in a rapidly changing industry landscape.

As of November current competitive trends in the fluoropolymers market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing supply chain reliability. The competitive differentiation appears to be shifting from price-based competition to a focus on technological advancements and sustainable practices, suggesting that companies that prioritize innovation and adaptability will likely thrive in the evolving market.