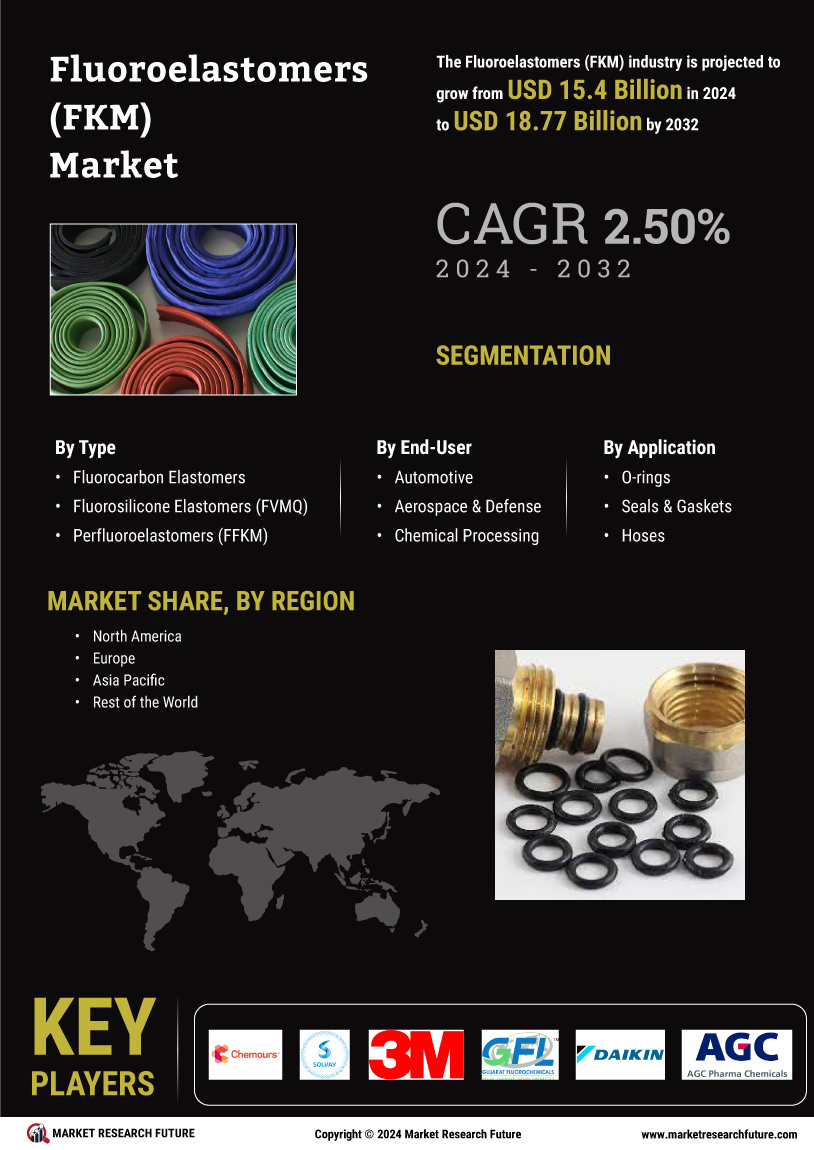

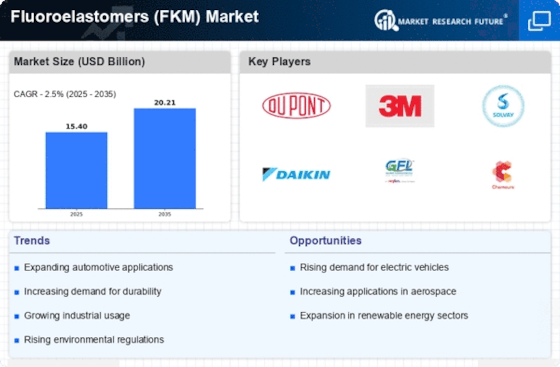

Expansion of the Automotive Sector

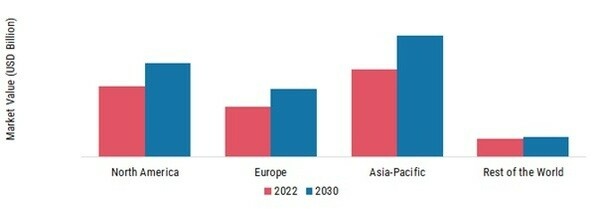

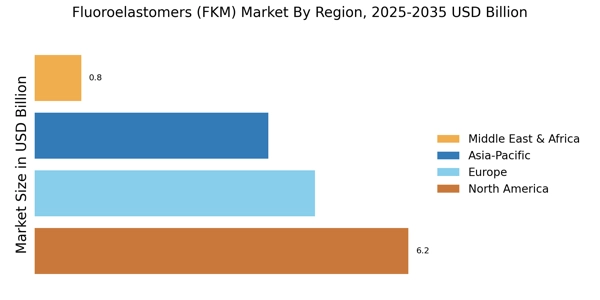

The Fluoroelastomers Market is closely linked to the expansion of the automotive sector, which is increasingly adopting advanced materials for improved performance and efficiency. FKM is utilized in various automotive applications, including fuel systems, gaskets, and seals, due to its superior resistance to fuels and oils. The automotive industry is projected to grow steadily, driven by the demand for electric vehicles and stringent emission regulations. This growth is likely to enhance the demand for FKM, as manufacturers seek materials that can meet the challenges posed by new technologies. The integration of fluoroelastomers in automotive components is expected to play a pivotal role in enhancing vehicle performance and longevity.

Rising Demand in Aerospace Applications

The Fluoroelastomers Market is witnessing a surge in demand from the aerospace sector, where high-performance materials are essential. FKM's ability to endure extreme temperatures and resist aggressive chemicals makes it an ideal choice for aerospace applications, including fuel systems and seals. The aerospace industry is expected to grow significantly, with an estimated increase in aircraft production and maintenance activities. This growth is likely to enhance the demand for FKM, as manufacturers prioritize materials that ensure safety and reliability. The integration of FKM in aerospace components not only improves performance but also contributes to weight reduction, which is a critical factor in modern aircraft design.

Regulatory Compliance and Safety Standards

The Fluoroelastomers Market is influenced by stringent regulatory compliance and safety standards across various sectors. Industries such as food and pharmaceuticals require materials that meet specific safety and health regulations. FKM's ability to comply with these standards while providing excellent chemical resistance makes it a preferred choice for applications in these sectors. As regulations become more stringent, the demand for compliant materials is likely to increase, driving the adoption of FKM. Furthermore, the emphasis on safety in manufacturing processes is expected to propel the market, as companies prioritize materials that ensure product integrity and consumer safety.

Technological Innovations in Material Science

The Fluoroelastomers Market is benefiting from ongoing technological innovations in material science. Advances in polymer chemistry and processing techniques are leading to the development of new grades of FKM that offer enhanced properties, such as improved flexibility and lower compression set. These innovations are crucial for industries that require high-performance materials capable of withstanding extreme conditions. The introduction of new formulations is expected to expand the application range of FKM, particularly in automotive and industrial sectors. As manufacturers continue to invest in research and development, the market for fluoroelastomers is likely to see a significant transformation, fostering growth and diversification.

Increasing Applications in Chemical Processing

The Fluoroelastomers Market is experiencing a notable increase in demand due to its extensive applications in chemical processing. Industries such as oil and gas, pharmaceuticals, and food processing utilize FKM for its exceptional resistance to chemicals, heat, and aging. This versatility allows FKM to be employed in seals, gaskets, and O-rings, which are critical components in maintaining system integrity. The chemical processing sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, further driving the demand for fluoroelastomers. As companies seek materials that can withstand harsh environments, the adoption of FKM is likely to expand, reinforcing its position in the market.