Market Share

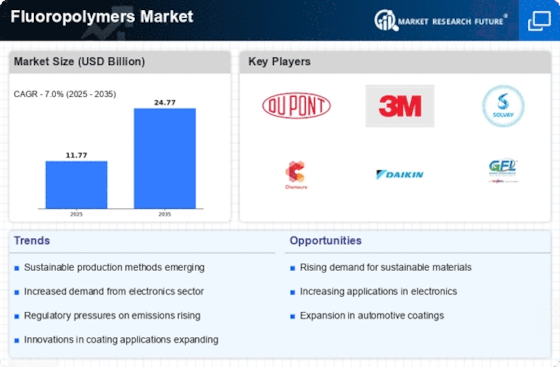

Fluoropolymers Market Share Analysis

Market share positioning strategies in the Fluoropolymers Market are pivotal for companies seeking to carve out a competitive edge and expand their presence in this specialized industry. Fluoropolymers, a group of high-performance plastics known for their unique properties such as heat resistance, chemical inertness, and low friction, find extensive applications in industries such as automotive, electronics, aerospace, and construction. To effectively position themselves in this market, companies employ various strategies:

Product Portfolio Diversification:

Companies focus on offering a diverse range of fluoropolymer products with different properties and functionalities, such as polytetrafluoroethylene (PTFE), polyvinylidene fluoride (PVDF), and fluorinated ethylene propylene (FEP). Diversification of product offerings allows companies to cater to a wide range of applications and industries within the Fluoropolymers Market, thereby maximizing market penetration and revenue generation. Targeted Market Segmentation:

Identifying and prioritizing key market segments based on industries, applications, and geographical regions enables companies to tailor their marketing strategies and product offerings. Segmentation helps companies focus their resources on specific customer needs and preferences, allowing them to effectively address niche markets and gain market share. Strategic Partnerships and Alliances:

Collaborating with key stakeholders such as OEMs, material suppliers, research institutions, and end-users allows companies to leverage complementary strengths and resources. Partnerships and alliances facilitate access to new technologies, market insights, and distribution channels, enabling companies to strengthen their competitive position in the Fluoropolymers Market. Brand Positioning and Marketing:

Establishing a strong brand identity centered around quality, reliability, and innovation is crucial for differentiating fluoropolymer products in a competitive market landscape. Investing in brand-building activities such as advertising, sponsorships, and digital marketing initiatives enhances brand visibility and credibility, driving customer preference and loyalty. Technical Expertise and Customer Support:

Demonstrating technical expertise and providing comprehensive customer support services, including material selection assistance, technical documentation, and application support, helps build trust and confidence among customers. Companies focus on offering value-added services such as custom formulation, testing, and validation to meet specific customer requirements and enhance customer satisfaction in the Fluoropolymers Market. Market Expansion and Geographic Reach:

Expanding into emerging markets and regions with growing industrial sectors presents opportunities for companies to diversify their customer base and revenue streams. Companies adapt their market positioning strategies to address regional preferences, regulatory frameworks, and market dynamics, enabling effective penetration and establishment in new geographic markets. Continuous Innovation and R&D Investments:

Continued investment in research and development (R&D) is essential for driving product innovation, improving performance, and staying ahead of competitors in the Fluoropolymers Market. Companies focus on developing advanced materials, enhancing processing technologies, and exploring new applications to meet evolving customer needs and capitalize on emerging trends. Sustainability Initiatives:

Incorporating sustainable practices such as eco-friendly materials, energy-efficient manufacturing processes, and recyclable packaging resonates with environmentally conscious customers and regulatory requirements. Companies communicate their commitment to sustainability through marketing campaigns and product labeling, enhancing brand reputation and attracting environmentally conscious customers in the Fluoropolymers Market. Market Monitoring and Adaptation:

Regularly monitoring market trends, competitor activities, and customer feedback enables companies to adapt their market positioning strategies in response to changing market dynamics. Being agile and responsive to market developments allows companies to seize opportunities, mitigate risks, and maintain a competitive edge in the Fluoropolymers Market.

Leave a Comment