Top Industry Leaders in the Flight Inspection Market

Flight Inspection Market

The Flight Inspection Market, a critical component of aviation safety, is witnessing a dynamic competitive landscape characterized by technological advancements and increasing demand for precise navigation systems. This sector plays a pivotal role in ensuring the accuracy and reliability of navigational aids, runway lighting, and communication systems. As aviation continues to grow globally, the need for efficient and reliable flight inspection solutions has led to intensified competition among key players.

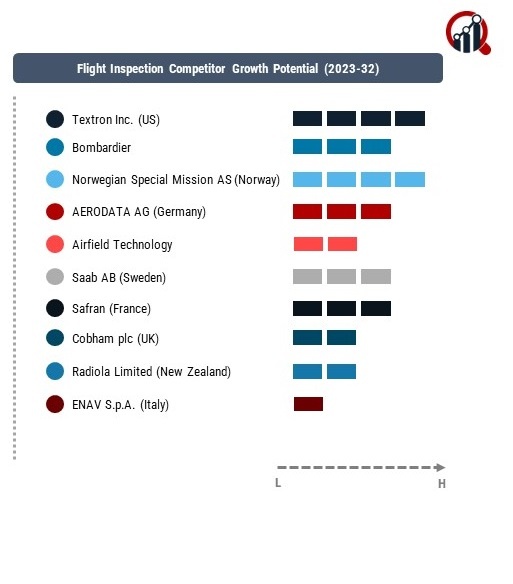

Key Players and Market Share Analysis:

Textron Inc. (US)

Bombardier

(Canada)

Norwegian Special Mission AS (Norway)

AERODATA AG (Germany)

Airfield Technology

(US), Saab AB (Sweden)

Safran (France)

Cobham plc (UK)

Radiola Limited (New Zealand)

ENAV S.p.A. (Italy)

MISTRAS Group (US)

ST Engineering (Singapore)

Strategies Adopted by Key Players:

The competitive landscape is marked by strategic initiatives undertaken by key players to stay ahead in the market. Companies are focusing on research and development activities to introduce innovative technologies, thereby gaining a competitive edge. Collaborations with regulatory bodies and aviation authorities are also common strategies to ensure compliance and facilitate the integration of advanced inspection systems. Textron, for instance, has been actively engaged in strategic partnerships to enhance its product portfolio, while Bombardier has been investing in research and development to bring cutting-edge solutions to the market.

Factors Influencing Market Share Analysis:

Several factors contribute to the market share dynamics within the Flight Inspection Market. Technological advancements, regulatory requirements, and the ability to provide integrated solutions play a crucial role. Companies investing in research and development to create state-of-the-art flight inspection systems tend to have a competitive advantage. Moreover, a global presence and a strong network of partnerships enable companies to cater to a broader customer base, impacting their market share positively. The adaptability of solutions to different types of aircraft and evolving industry standards also influence market share dynamics.

New and Emerging Companies:

The Flight Inspection Market is witnessing the emergence of new players eager to capitalize on the growing demand for advanced flight inspection solutions. Among the emerging companies are Flight Precision Ltd. (UK), Avionics Support Group, Inc. (US), and Aerodata AG (Germany). These companies are carving their niche by offering specialized solutions and leveraging technological innovations. The competitive landscape is evolving as these entrants challenge established players, bringing fresh perspectives and fostering innovation within the market.

Industry News and Trends:

Continuous innovation and evolving industry trends are shaping the Flight Inspection Market. One notable trend is the integration of artificial intelligence (AI) and machine learning (ML) technologies in flight inspection systems. This enables real-time data analysis, predictive maintenance, and improved overall system performance. Industry news highlights collaborations between major players and research institutions to explore the potential of AI in enhancing the accuracy and efficiency of flight inspection processes. Additionally, the increasing focus on sustainability and environmentally friendly solutions is influencing the development of eco-friendly flight inspection technologies.

Current Company Investment Trends:

Investment trends within the Flight Inspection Market indicate a strong focus on technological advancements and global expansion. Companies are allocating substantial resources to research and development activities to stay at the forefront of innovation. Safran, for instance, has made significant investments in enhancing its flight inspection solutions, ensuring they align with the latest industry standards. Additionally, strategic acquisitions and partnerships are prevalent, allowing companies to diversify their product portfolios and extend their market reach.

Overall Competitive Scenario:

The overall competitive scenario in the Flight Inspection Market is marked by intense rivalry among key players, as well as the entry of new and innovative companies. The market dynamics are influenced by factors such as technological advancements, regulatory compliance, and global partnerships. Companies are adopting diverse strategies, including mergers, acquisitions, collaborations, and investments in research and development, to maintain a competitive edge. The integration of AI and ML technologies, coupled with a focus on sustainability, reflects the industry's commitment to staying at the forefront of aviation safety and navigation. As the demand for precise flight inspection solutions continues to rise, the competitive landscape is expected to evolve further, with companies striving to meet the ever-changing needs of the aviation industry.

Company News:

Safran: In October 2023, Safran unveiled a new 10-year contract with the French Civil Aviation Authority (DGAC) to deliver flight inspection services. This strategic move further solidifies Safran's prominent standing as a key player in the European flight inspection market.

Saab: By November 2023, Saab successfully handed over its 30th Giraffe 4A Active GaN radar system to the Swedish Defense Materiel Administration (FMV). Renowned for its versatility, Giraffe radars find applications in diverse fields, including flight inspection, bolstering Saab's comprehensive offerings within the market.

Leonardo DRS (formerly Cobham): In September 2023, Leonardo DRS introduced the cutting-edge AviatorTM 300MFI Multi-Function Instrument, a compact and lightweight solution tailored for flight inspection missions. This innovative product establishes Leonardo DRS as a leading provider of contemporary inspection equipment.

Enav: Making headlines in July 2023, Enav secured a five-year contract with the Italian Civil Aviation Authority (ENAC) to deliver flight inspection services. This agreement serves as a testament to Enav's prominent position as a leader in the Italian flight inspection market.