Increased Focus on Patient Safety

The Fixed and Mobile C-arm Market is increasingly shaped by a heightened focus on patient safety and quality of care. Healthcare providers are prioritizing technologies that minimize radiation exposure while maximizing imaging quality. Innovations in C-arm design, such as dose-reduction features and enhanced imaging algorithms, are becoming critical selling points. Regulatory bodies are also emphasizing safety standards, which encourages manufacturers to develop safer imaging solutions. As hospitals and clinics strive to meet these standards, the demand for advanced C-arms that prioritize patient safety is likely to grow. This focus on safety not only enhances patient outcomes but also aligns with the broader healthcare trend towards quality improvement, potentially leading to a market growth rate of around 6% in the coming years.

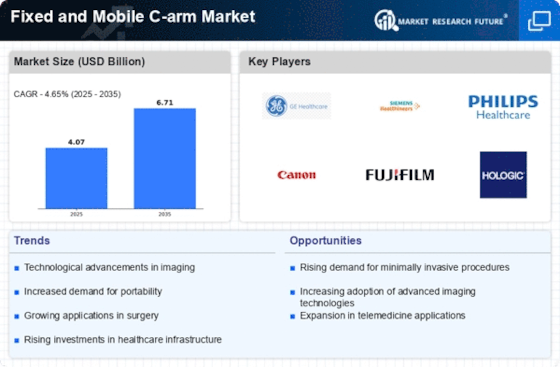

Technological Innovations in Imaging

The Fixed and Mobile C-arm Market is experiencing a surge in technological innovations that enhance imaging capabilities. Advanced features such as 3D imaging, real-time visualization, and improved image quality are becoming standard. These innovations not only facilitate better diagnostic accuracy but also improve surgical outcomes. The integration of artificial intelligence and machine learning into imaging systems is also noteworthy, as it aids in image analysis and interpretation. As hospitals and surgical centers increasingly adopt these advanced systems, the demand for both fixed and mobile C-arms is likely to rise. Market data indicates that the adoption of these technologies could lead to a projected growth rate of approximately 7% annually in the coming years, reflecting the industry's responsiveness to technological advancements.

Growth in Ambulatory Surgical Centers

The Fixed and Mobile C-arm Market is witnessing growth due to the proliferation of ambulatory surgical centers (ASCs). These facilities are increasingly favored for their efficiency and cost-effectiveness, providing a wide range of surgical procedures with reduced patient recovery times. C-arms are essential in ASCs, as they enable minimally invasive surgeries that require precise imaging. The convenience of mobile C-arms allows for flexibility in surgical settings, further enhancing their appeal. Market analysis suggests that the number of ASCs is projected to grow by 10% annually, driven by the shift towards outpatient care. This trend is likely to bolster the demand for both fixed and mobile C-arms, as ASCs seek to equip themselves with advanced imaging technologies.

Rising Prevalence of Chronic Diseases

The Fixed and Mobile C-arm Market is significantly influenced by the rising prevalence of chronic diseases, which necessitate advanced imaging solutions for effective diagnosis and treatment. Conditions such as cardiovascular diseases, orthopedic disorders, and cancer are on the rise, leading to an increased demand for surgical interventions that utilize C-arm imaging. The ability of C-arms to provide real-time imaging during procedures enhances the precision of interventions, making them indispensable in modern healthcare. According to recent statistics, the incidence of chronic diseases is expected to increase by 15% over the next decade, thereby driving the demand for C-arms. This trend underscores the critical role that fixed and mobile C-arms play in managing complex medical conditions.

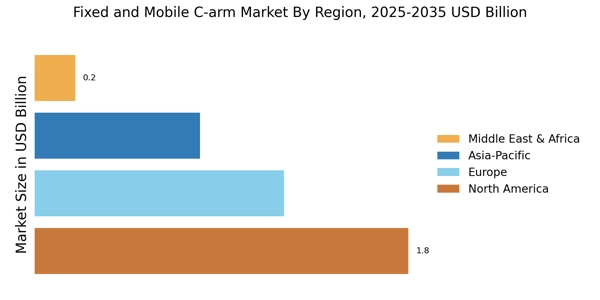

Expansion of Healthcare Infrastructure

The Fixed and Mobile C-arm Market is benefiting from the expansion of healthcare infrastructure, particularly in emerging economies. As these regions invest in modernizing their healthcare facilities, the demand for advanced imaging technologies, including C-arms, is on the rise. New hospitals and surgical centers are increasingly incorporating fixed and mobile C-arms into their operations to enhance diagnostic and surgical capabilities. This trend is supported by government initiatives aimed at improving healthcare access and quality. Market projections indicate that the healthcare infrastructure in these regions could expand by 8% annually, creating a favorable environment for the growth of the C-arm market. This expansion not only reflects the increasing need for advanced medical technologies but also highlights the potential for market players to capitalize on new opportunities.