Rising Demand for Integrated Solutions

the fixed mobile-convergence market in France is seeing a surge in demand for integrated solutions. Consumers increasingly prefer bundled services that combine fixed-line and mobile offerings, seeking convenience and cost savings. This trend is reflected in the market data, which indicates that approximately 60% of households in France now utilize bundled services. The appeal lies in the seamless connectivity and unified billing, which enhances user experience. As competition intensifies among service providers, the emphasis on integrated solutions is likely to drive innovation and service diversification within the fixed mobile-convergence market. Providers are compelled to adapt their strategies to meet evolving consumer preferences, potentially leading to new service models that further integrate mobile and fixed-line services.

Regulatory Framework and Policy Support

The regulatory framework in France plays a crucial role in shaping the fixed mobile-convergence market. Government policies aimed at promoting competition and investment in telecommunications infrastructure are essential for market growth. Recent initiatives have focused on reducing barriers to entry for new players and encouraging infrastructure sharing among existing providers. This regulatory support is expected to foster innovation and enhance service availability across the country. As of November 2025, the French government has allocated approximately €1 billion to support broadband expansion in rural areas, which is likely to enhance the reach of fixed mobile-convergence services. Such policy measures are instrumental in creating a conducive environment for the growth of the fixed mobile-convergence market.

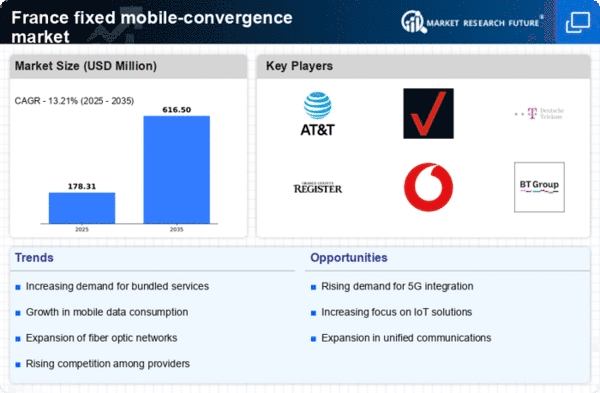

Competitive Landscape and Market Consolidation

The competitive landscape of the fixed mobile-convergence market in France is characterized by ongoing market consolidation and strategic partnerships. Major players are increasingly merging or forming alliances to enhance their service offerings and expand their market reach. This trend is likely to intensify as companies seek to leverage synergies and optimize operational efficiencies. Recent data suggests that the top three providers control approximately 70% of the market share, indicating a concentrated competitive environment. Such consolidation may lead to improved service quality and innovation, as companies invest in advanced technologies and customer-centric solutions. The dynamics of competition will continue to shape the fixed mobile-convergence market, influencing pricing strategies and service differentiation.

Consumer Preference for Mobility and Flexibility

Consumer preferences are shifting towards mobility and flexibility, significantly impacting the fixed mobile-convergence market in France. As lifestyles become increasingly mobile, users demand services that allow them to stay connected regardless of location. This trend is evidenced by the growing adoption of mobile applications that complement fixed services, with over 50% of users indicating a preference for mobile access to their fixed-line services. The desire for flexibility in service usage is prompting providers to innovate and offer more adaptable solutions. This shift may lead to the development of new pricing models and service packages that cater to the dynamic needs of consumers, thereby enhancing the overall appeal of the fixed mobile-convergence market.

Technological Advancements in Network Infrastructure

Technological advancements play a pivotal role in shaping the fixed mobile-convergence market in France. The deployment of next-generation network technologies, such as 5G and fiber-optic broadband, enhances the capabilities of service providers to deliver high-speed, reliable services. As of November 2025, the penetration of fiber-optic connections in French households has reached approximately 40%, facilitating improved service quality. These advancements not only support the convergence of fixed and mobile services but also enable innovative applications, such as smart home technologies and IoT solutions. Consequently, service providers are likely to invest heavily in upgrading their infrastructure to remain competitive in the evolving landscape of the fixed mobile-convergence market.