Rising Consumer Expectations

The fixed mobile-convergence market is experiencing a notable shift as consumer expectations evolve. Users increasingly demand seamless integration of services, which compels providers to enhance their offerings. In the UK, approximately 70% of consumers express a preference for bundled services that combine mobile and fixed-line capabilities. This trend indicates a growing desire for convenience and efficiency, pushing companies to innovate and adapt. As competition intensifies, businesses are likely to invest in advanced technologies to meet these expectations, thereby driving growth in the fixed mobile-convergence market. The need for improved customer experience is paramount, as companies strive to retain existing customers while attracting new ones. This dynamic environment suggests that organizations must remain agile and responsive to consumer demands to thrive in the fixed mobile-convergence market.

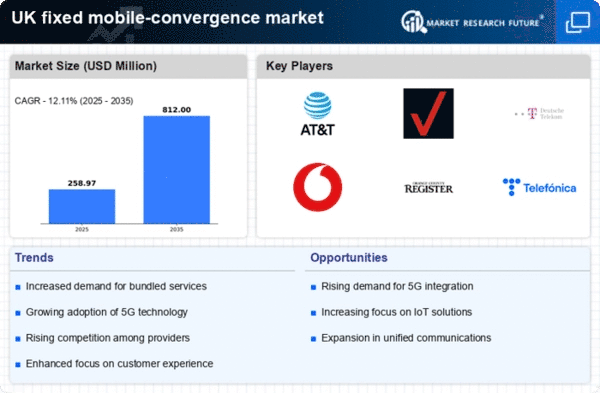

Expansion of 5G Infrastructure

The rollout of 5G technology is a critical driver for the fixed mobile-convergence market. In the UK, the expansion of 5G infrastructure is expected to enhance connectivity and enable new service offerings. With 5G networks providing significantly higher speeds and lower latency, businesses can deliver more robust and reliable services. This technological advancement is projected to increase the adoption of converged solutions, as consumers and enterprises alike seek to leverage the benefits of enhanced mobile connectivity. By 2026, it is anticipated that 5G will cover over 90% of the UK population, creating a fertile ground for the fixed mobile-convergence market to flourish. The integration of 5G capabilities into existing fixed-line services may lead to innovative applications and improved user experiences, further propelling market growth.

Regulatory Changes and Support

Regulatory frameworks play a pivotal role in shaping the fixed mobile-convergence market. In the UK, recent regulatory changes aimed at promoting competition and innovation are likely to have a profound impact. The government has been actively encouraging the convergence of services to enhance consumer choice and drive down prices. This supportive regulatory environment may facilitate investments in infrastructure and technology, enabling providers to offer more integrated solutions. As regulations evolve, companies in the fixed mobile-convergence market must adapt to comply with new standards while leveraging opportunities for growth. The potential for regulatory incentives could further stimulate market activity, encouraging providers to innovate and expand their service portfolios.

Increased Competition Among Providers

The fixed mobile-convergence market is witnessing heightened competition among service providers, which is driving innovation and service differentiation. In the UK, numerous telecommunications companies are vying for market share, leading to aggressive pricing strategies and enhanced service offerings. This competitive landscape compels providers to invest in new technologies and improve customer service to maintain their positions. As a result, consumers benefit from a wider array of choices and potentially lower prices. The competition also encourages companies to explore partnerships and collaborations, further enriching the fixed mobile-convergence market. With the entry of new players and the expansion of existing ones, the market is likely to see a surge in innovative solutions that cater to diverse consumer needs, thereby fostering growth and development.

Growing Demand for Remote Work Solutions

The shift towards remote work has created a burgeoning demand for integrated communication solutions, significantly impacting the fixed mobile-convergence market. In the UK, businesses are increasingly seeking reliable and efficient tools that facilitate remote collaboration. This trend has led to a surge in the adoption of unified communication platforms that combine voice, video, and messaging services. As organizations prioritize flexibility and connectivity, the need for converged solutions becomes more pronounced. It is estimated that by 2027, over 50% of the UK workforce may engage in remote work, further driving the demand for integrated services. This evolving work landscape presents a substantial opportunity for providers in the fixed mobile-convergence market to develop tailored solutions that meet the needs of businesses and their employees.