Consumer Demand for Integrated Services

The fixed mobile-convergence market in Germany is experiencing a surge in consumer demand for integrated services. As households increasingly seek convenience, the appeal of bundled offerings that combine fixed-line and mobile services becomes evident. Recent data indicates that approximately 60% of German consumers prefer packages that include both internet and mobile services, reflecting a shift in purchasing behavior. This trend is likely driven by the desire for simplified billing and enhanced user experience. Moreover, the growing reliance on digital communication and entertainment platforms further fuels this demand. As a result, service providers are compelled to innovate and create attractive packages that cater to these preferences, thereby enhancing their competitive positioning in the fixed mobile-convergence market. The ability to offer seamless connectivity across devices is becoming a critical factor for success in this evolving landscape.

Regulatory Framework and Policy Support

The regulatory framework in Germany significantly influences the dynamics of the fixed mobile-convergence market. Recent policy initiatives aimed at promoting competition and consumer protection have created a conducive environment for market growth. The Federal Network Agency (BNetzA) has implemented regulations that encourage fair pricing and transparency in service offerings. These measures are designed to prevent monopolistic practices and ensure that consumers have access to a variety of choices. Additionally, the government's commitment to digitalization and broadband expansion aligns with the objectives of the fixed mobile-convergence market, fostering an ecosystem that supports innovation. As regulatory support continues to evolve, it is likely to play a crucial role in shaping the competitive landscape and driving market growth.

Investment in Infrastructure Development

Infrastructure development plays a pivotal role in shaping the fixed mobile-convergence market in Germany. The ongoing investments in fiber-optic networks and 5G technology are crucial for enhancing service quality and expanding coverage. Recent reports suggest that Germany has allocated over €10 billion towards the expansion of broadband infrastructure, aiming to achieve nationwide high-speed internet access. This investment is expected to facilitate the integration of fixed and mobile services, allowing providers to offer more reliable and faster connections. As the demand for high-bandwidth applications continues to rise, the enhancement of infrastructure is likely to be a key driver in attracting new customers and retaining existing ones. Consequently, the fixed mobile-convergence market is poised for growth as infrastructure improvements enable service providers to deliver superior offerings.

Technological Integration and User Experience

Technological integration is a fundamental driver of the fixed mobile-convergence market in Germany. The rapid advancement of technologies such as VoIP, cloud computing, and IoT is reshaping how consumers interact with telecommunications services. Enhanced user experience is becoming a priority, as customers expect seamless connectivity across devices and platforms. Recent surveys indicate that over 70% of users value the ability to manage their services through unified applications. This demand for integrated solutions is prompting service providers to invest in innovative technologies that enhance service delivery and customer engagement. As a result, the fixed mobile-convergence market is likely to evolve, with companies focusing on creating user-friendly interfaces and comprehensive service ecosystems that cater to the needs of modern consumers.

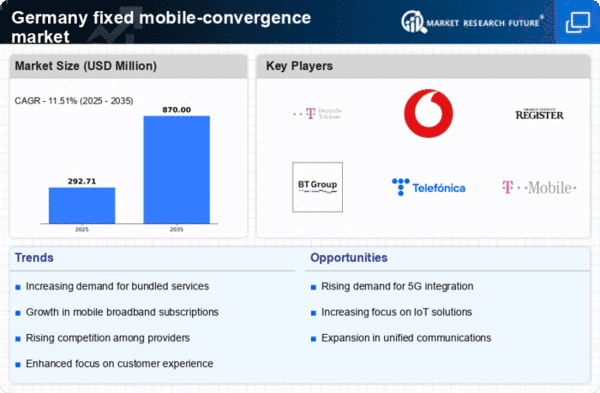

Competitive Landscape and Market Consolidation

The competitive landscape within the fixed mobile-convergence market in Germany is characterized by ongoing market consolidation and strategic partnerships. Major telecommunications companies are increasingly merging or forming alliances to enhance their service portfolios and market reach. This trend is evidenced by recent mergers that have resulted in a more concentrated market, with a few key players dominating the landscape. Such consolidation allows companies to leverage economies of scale, reduce operational costs, and invest in innovative technologies. Furthermore, the competitive pressure encourages providers to differentiate their offerings, leading to improved service quality and customer satisfaction. As a result, the fixed mobile-convergence market is likely to witness intensified competition, compelling companies to continuously adapt and innovate to maintain their market positions.