Increasing Health Consciousness

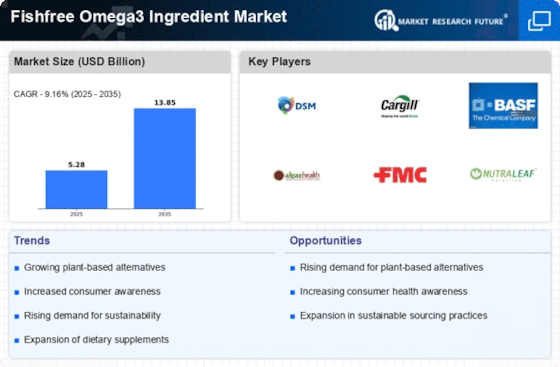

The Fishfree Omega3 Ingredient Market is experiencing a notable surge in demand driven by a growing awareness of health and wellness among consumers. Individuals are increasingly seeking dietary supplements that offer health benefits without the drawbacks associated with fish-based products. This trend is reflected in the rising sales of plant-based omega-3 supplements, which are perceived as safer and more sustainable. According to recent data, the market for plant-based omega-3 fatty acids is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This shift towards health-conscious choices is likely to propel the Fishfree Omega3 Ingredient Market further, as consumers prioritize products that align with their health goals.

Rising Vegan and Vegetarian Populations

The Fishfree Omega3 Ingredient Market is significantly impacted by the increasing number of individuals adopting vegan and vegetarian lifestyles. As more consumers choose to eliminate animal products from their diets, the demand for plant-based omega-3 sources is rising. This demographic shift is prompting manufacturers to develop innovative products that cater to the nutritional needs of these populations. Market analysis indicates that the plant-based dietary supplement sector is expanding rapidly, with omega-3 products being a key focus area. The growing vegan and vegetarian populations are likely to drive sustained growth in the Fishfree Omega3 Ingredient Market, as these consumers actively seek alternatives that align with their dietary preferences.

Technological Advancements in Production

The Fishfree Omega3 Ingredient Market is witnessing significant advancements in production technologies that enhance the extraction and formulation of omega-3 fatty acids from plant sources. Innovations in extraction techniques, such as supercritical CO2 extraction and enzymatic processes, are improving the yield and purity of omega-3 oils derived from algae and other plant sources. These technological improvements not only increase the efficiency of production but also ensure that the final products meet high-quality standards. As a result, manufacturers are better positioned to compete with traditional fish oil products, potentially expanding their market share within the Fishfree Omega3 Ingredient Market. The ongoing research and development in this area suggest a promising future for plant-based omega-3 solutions.

Environmental Concerns and Sustainability

The Fishfree Omega3 Ingredient Market is increasingly influenced by environmental concerns surrounding overfishing and marine ecosystem degradation. Consumers are becoming more aware of the ecological impact of traditional fish oil production, leading to a shift towards sustainable alternatives. Plant-based omega-3 sources, such as algae, are viewed as environmentally friendly options that do not contribute to the depletion of marine resources. This growing emphasis on sustainability is prompting companies to adopt eco-friendly practices and promote their products as sustainable choices. Market data indicates that products labeled as sustainable are experiencing higher demand, which is likely to drive growth in the Fishfree Omega3 Ingredient Market as consumers seek to make responsible purchasing decisions.

Regulatory Support for Plant-Based Ingredients

The Fishfree Omega3 Ingredient Market is benefiting from an increasingly favorable regulatory environment that supports the use of plant-based ingredients. Governments and health organizations are promoting the consumption of omega-3 fatty acids due to their recognized health benefits, which include cardiovascular health and cognitive function. This regulatory backing is encouraging manufacturers to innovate and expand their product lines to include fish-free alternatives. As a result, the market is witnessing a diversification of offerings, with new formulations and delivery methods emerging. The regulatory support not only enhances consumer confidence but also stimulates investment in research and development within the Fishfree Omega3 Ingredient Market, potentially leading to new breakthroughs in product efficacy and safety.