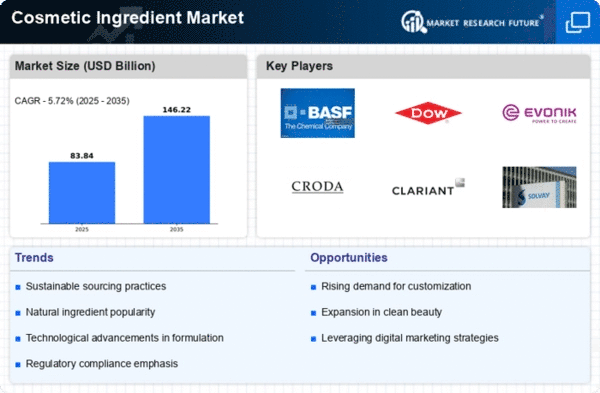

Market Growth Projections

The Global Cosmetic Ingredients Market Industry is poised for substantial growth, with projections indicating a market value of 79.3 USD Billion in 2024 and an anticipated increase to 146.2 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 5.72% from 2025 to 2035. Factors contributing to this expansion include rising consumer awareness of ingredient safety, technological advancements in formulation, and a shift towards sustainable practices. As the industry evolves, stakeholders must remain agile to adapt to changing consumer preferences and regulatory landscapes, ensuring continued relevance in a competitive market.

Diverse Consumer Preferences

The Global Cosmetic Ingredients Market Industry is characterized by diverse consumer preferences driven by cultural, regional, and demographic factors. This diversity necessitates a wide range of cosmetic formulations tailored to meet varying consumer needs. For instance, the demand for products catering to specific skin types or concerns is on the rise, prompting brands to innovate and diversify their ingredient offerings. As a result, companies are increasingly focusing on personalization in their product lines, which is likely to enhance customer loyalty and satisfaction. This trend contributes to the overall growth of the market, with expectations of reaching 79.3 USD Billion in 2024.

Increasing Awareness of Skin Health

There is a growing awareness among consumers regarding skin health and the role of cosmetic ingredients in maintaining it. The Global Cosmetic Ingredients Market Industry is benefiting from this trend, as consumers seek products that offer not only aesthetic benefits but also functional attributes such as hydration, anti-aging, and sun protection. This heightened awareness is driving demand for ingredients that are clinically proven to enhance skin health, prompting brands to highlight their formulations' efficacy. As a result, the market is expected to witness substantial growth, with a projected value of 79.3 USD Billion in 2024, reflecting the increasing consumer focus on health-oriented cosmetic products.

Rising Demand for Natural Ingredients

The Global Cosmetic Ingredients Market Industry is experiencing a notable shift towards natural and organic ingredients. Consumers increasingly prioritize products that are free from synthetic chemicals, leading to a surge in demand for plant-based alternatives. This trend is reflected in the market's projected growth, with the industry expected to reach 79.3 USD Billion in 2024. Brands are responding by reformulating products to include botanical extracts and essential oils, which are perceived as safer and more environmentally friendly. This shift not only caters to consumer preferences but also aligns with regulatory trends favoring sustainable practices in cosmetic formulations.

Technological Advancements in Formulation

Innovations in cosmetic formulation technologies are significantly influencing the Global Cosmetic Ingredients Market Industry. Advanced techniques such as microencapsulation and nanotechnology enhance the delivery and efficacy of active ingredients. These technologies allow for improved stability and longer shelf life of products, which is crucial for maintaining consumer trust and satisfaction. As a result, the market is projected to grow at a CAGR of 5.72% from 2025 to 2035, reaching 146.2 USD Billion by 2035. Companies investing in research and development to leverage these advancements are likely to gain a competitive edge in this rapidly evolving landscape.

Regulatory Support for Sustainable Practices

Regulatory frameworks globally are increasingly supporting sustainable practices within the cosmetic industry. The Global Cosmetic Ingredients Market Industry is adapting to these changes, as governments implement stricter guidelines on ingredient sourcing and environmental impact. This regulatory support encourages manufacturers to adopt eco-friendly practices, such as using sustainably sourced raw materials and minimizing waste in production processes. Consequently, brands that align with these regulations not only enhance their marketability but also contribute to a more sustainable industry. This trend is likely to propel the market forward, with projections indicating a growth trajectory towards 146.2 USD Billion by 2035.