North America : Market Leader in Repair Services

North America is poised to maintain its leadership in the Factory Lighting Systems Repair and MRO Services Market, holding a significant market share of 1.25B in 2024. The region's growth is driven by increasing industrial automation, stringent safety regulations, and a shift towards energy-efficient lighting solutions. Additionally, government initiatives promoting sustainable practices are catalyzing demand for repair services, ensuring compliance with environmental standards.

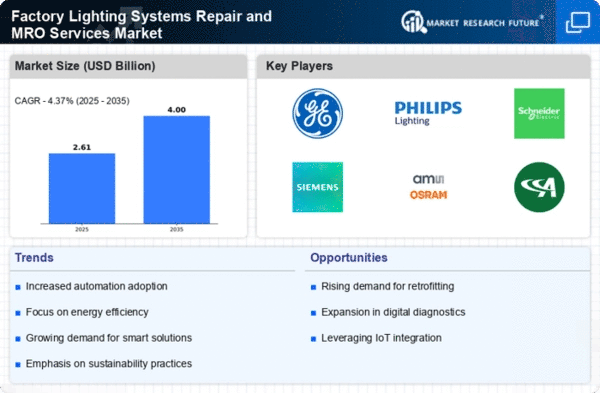

The competitive landscape in North America is robust, featuring key players such as General Electric, Philips Lighting, and Honeywell. These companies are leveraging advanced technologies and innovative solutions to enhance service offerings. The U.S. stands out as the leading country, supported by a strong manufacturing base and a focus on modernization. The presence of established firms fosters a dynamic market environment, driving further growth and innovation.

Europe : Emerging Market with Growth Potential

Europe is witnessing a revitalization in the Factory Lighting Systems Repair and MRO Services Market, with a market size of 0.75B in 2024. The region's growth is fueled by increasing investments in smart manufacturing and a commitment to sustainability. Regulatory frameworks, such as the EU's Green Deal, are pushing industries towards energy-efficient solutions, thereby enhancing the demand for repair and maintenance services in the lighting sector.

Leading countries like Germany, France, and the Netherlands are at the forefront of this transformation, supported by key players such as Siemens and Philips Lighting. The competitive landscape is characterized by innovation and collaboration among firms to meet evolving customer needs. As industries adapt to new technologies, the market is expected to expand, driven by a focus on efficiency and sustainability.

Asia-Pacific : Rapid Growth in Emerging Markets

Asia-Pacific is emerging as a significant player in the Factory Lighting Systems Repair and MRO Services Market, with a market size of 0.4B in 2024. The region's growth is driven by rapid industrialization, urbanization, and increasing demand for energy-efficient lighting solutions. Governments are implementing policies to enhance energy efficiency, which is further propelling the demand for repair services in the manufacturing sector.

Countries like China and India are leading the charge, supported by a growing number of local and international players. Companies such as Schneider Electric and Cree Lighting are expanding their presence, focusing on innovative solutions to cater to the diverse needs of the market. The competitive landscape is evolving, with a mix of established firms and new entrants driving growth and technological advancements.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is in the nascent stages of developing its Factory Lighting Systems Repair and MRO Services Market, with a market size of 0.1B in 2024. The growth is primarily driven by increasing industrial activities and a rising focus on energy efficiency. Governments are beginning to recognize the importance of sustainable practices, which is expected to catalyze demand for repair services in the lighting sector.

Countries like South Africa and the UAE are leading the way, with a growing number of local and international players entering the market. The competitive landscape is characterized by emerging firms looking to establish a foothold in this developing market. As industries evolve, the demand for efficient lighting solutions and repair services is anticipated to grow, presenting significant opportunities for investment and development.