Market Analysis

In-depth Analysis of Expanded Polystyrene Market Industry Landscape

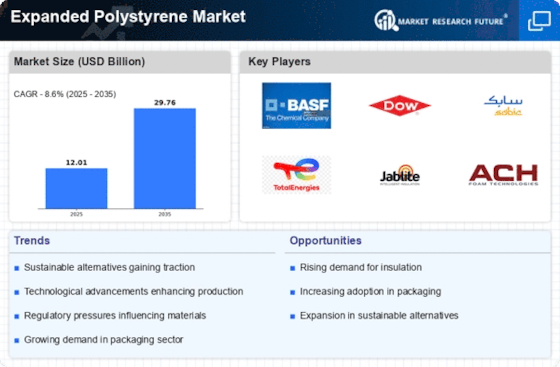

The market dynamics of the expanded polystyrene (EPS) industry are influenced by various factors that drive supply, demand, and pricing. EPS, a lightweight plastic foam material, is widely used in packaging, insulation, and construction due to its excellent thermal insulation properties and versatility. One key factor affecting the market is the growth of end-use industries such as construction, electronics, and packaging. As urbanization and industrialization continue to expand globally, there is a growing demand for EPS in construction applications like insulation boards, concrete formwork, and lightweight fill materials. Similarly, the increasing popularity of online shopping and the need for protective packaging solutions have boosted the demand for EPS in the packaging sector.

The automotive industry is attracting manufacturers to donate a certain sum in this market. The growth in demand of emerging countries has given a great opportunity to the key players to cope up with the growth of markets. Recycling these products provides opportunities for expanding the growth of the business.

Another important driver of market dynamics is regulatory policies and environmental concerns. With growing awareness about environmental issues, there is a shift towards sustainable and eco-friendly materials in various industries. This has led to increased scrutiny of EPS due to its non-biodegradable nature and concerns about its impact on the environment, particularly marine ecosystems. As a result, there is a growing demand for alternative materials and recycling initiatives to minimize the environmental footprint of EPS products. Regulatory measures such as bans on single-use plastics and restrictions on EPS packaging in certain regions also affect market dynamics by influencing consumption patterns and driving innovation towards more sustainable solutions.

Supply dynamics also play a crucial role in shaping the EPS market. The production of EPS involves the expansion of polystyrene beads using steam, which requires significant energy inputs. Factors such as energy costs, raw material availability, and technological advancements in manufacturing processes influence the supply side of the market. Additionally, the EPS industry is characterized by consolidation, with a few major players dominating the market globally. Mergers and acquisitions, capacity expansions, and strategic alliances among key players impact supply chain dynamics, market competition, and pricing strategies.

Price volatility is another factor that affects market dynamics in the EPS industry. The price of EPS is influenced by factors such as raw material costs, energy prices, supply-demand dynamics, and currency fluctuations. Volatility in crude oil prices, which is a key raw material for polystyrene production, can have a significant impact on EPS prices. Additionally, changes in demand patterns, seasonal fluctuations, and macroeconomic factors such as economic growth and inflation can contribute to price variability in the market.

In response to these market dynamics, stakeholders in the EPS industry are adopting various strategies to remain competitive and address sustainability concerns. This includes investing in research and development to innovate new products with improved performance and environmental credentials. Companies are also focusing on expanding their recycling capabilities and developing closed-loop systems to minimize waste and promote circularity in the EPS value chain. Furthermore, collaborations between industry players, government agencies, and non-profit organizations are driving initiatives to promote sustainable practices and advance the development of bio-based and biodegradable alternatives to EPS.

Leave a Comment