Growth in Consumer Electronics

The Polystyrene Market is also benefiting from the growth in the consumer electronics sector. As technology advances, the demand for lightweight and durable materials for electronic devices is on the rise. Polystyrene is commonly used in the production of casings and protective packaging for various electronic products. In 2025, the consumer electronics market is projected to expand by approximately 5 percent, which will likely drive the demand for polystyrene components. This trend is indicative of a broader shift towards more efficient and sustainable manufacturing practices, where polystyrene's versatility plays a crucial role. Therefore, the Polystyrene Market is expected to thrive as it aligns with the evolving needs of the electronics industry.

Increased Focus on Sustainability

The Polystyrene Market is witnessing a shift towards sustainability, as consumers and manufacturers alike become more environmentally conscious. The demand for recyclable and eco-friendly materials is on the rise, prompting innovations in polystyrene production and recycling processes. In 2025, it is anticipated that the market for recycled polystyrene will grow significantly, as companies seek to reduce their carbon footprint. This trend is further supported by regulatory frameworks that encourage the use of sustainable materials in various applications. As a result, the Polystyrene Market is likely to adapt to these changes, focusing on developing products that meet sustainability criteria while maintaining performance standards.

Expansion of the Automotive Sector

The Polystyrene Market is poised for growth due to the expansion of the automotive sector. Polystyrene is increasingly utilized in automotive applications, including interior components and insulation materials. As the automotive industry evolves towards lightweight materials to enhance fuel efficiency, the demand for polystyrene is expected to rise. In 2025, the automotive sector is projected to grow at a rate of around 3.5 percent, which will likely drive the consumption of polystyrene products. This trend reflects a broader industry shift towards sustainability and efficiency, where polystyrene's properties align well with the needs of modern automotive design. Consequently, the Polystyrene Market is set to benefit from this expansion.

Innovations in Packaging Solutions

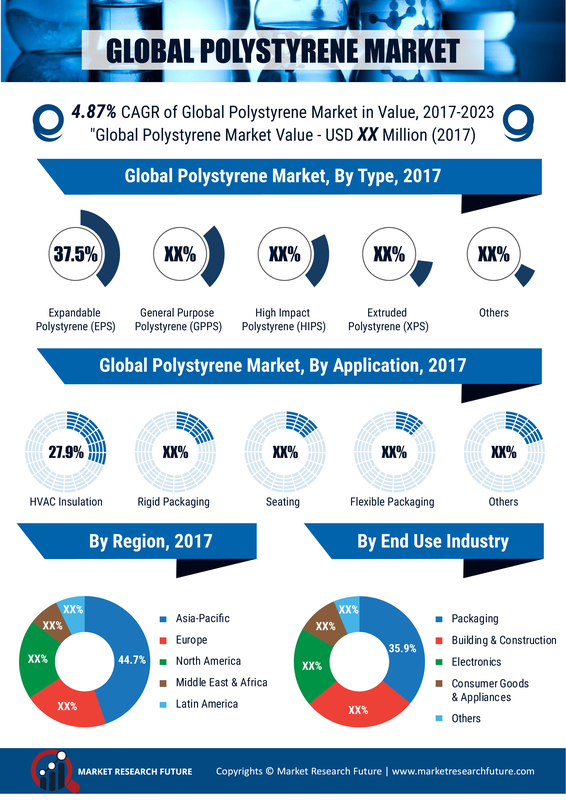

The Polystyrene Market is significantly influenced by innovations in packaging solutions. With the rise of e-commerce and the need for efficient shipping methods, polystyrene's lightweight and protective properties make it an ideal choice for packaging materials. In 2025, the packaging segment is expected to account for over 40 percent of the total polystyrene consumption. This is largely due to the material's ability to provide cushioning and insulation, ensuring product safety during transit. Furthermore, advancements in polystyrene recycling technologies are likely to enhance its appeal in the packaging sector, as companies increasingly prioritize sustainability. Thus, the Polystyrene Market stands to gain from these developments, as manufacturers adapt to changing consumer preferences.

Rising Demand in Construction Sector

The Polystyrene Market is experiencing a notable surge in demand driven by the construction sector. Polystyrene is widely utilized in insulation materials, which are essential for energy-efficient buildings. As energy regulations become more stringent, the need for effective insulation solutions is likely to increase. In 2025, the construction industry is projected to grow at a rate of approximately 4.5 percent annually, further propelling the demand for polystyrene products. This growth is attributed to urbanization and infrastructure development, which necessitate the use of lightweight and durable materials. Consequently, the Polystyrene Market is poised to benefit from this trend, as builders and contractors seek cost-effective solutions that meet modern energy standards.