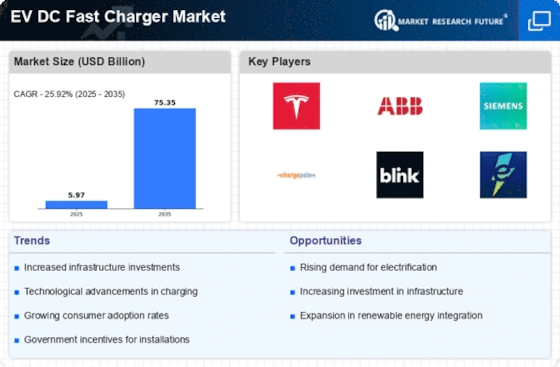

Increasing Electric Vehicle Adoption

The rising adoption of electric vehicles (EVs) is a primary driver for the EV DC Fast Charger Market. As consumers increasingly opt for EVs due to environmental concerns and government incentives, the demand for efficient charging solutions escalates. In 2025, it is estimated that the number of electric vehicles on the road will surpass 30 million, creating a substantial need for fast charging infrastructure. This surge in EV adoption is likely to propel the growth of the EV DC Fast Charger Market, as consumers seek convenient and rapid charging options to alleviate range anxiety. Furthermore, the transition to electric mobility is supported by various policies aimed at reducing carbon emissions, which further enhances the market potential for DC fast chargers.

Government Initiatives and Incentives

Government initiatives and incentives play a crucial role in shaping the EV DC Fast Charger Market. Many governments are implementing policies that promote the installation of charging stations, including tax credits, grants, and subsidies for both consumers and businesses. For instance, in 2025, several countries have allocated significant budgets to expand their EV charging networks, with some aiming to install thousands of new fast chargers. These initiatives not only encourage the adoption of electric vehicles but also stimulate investments in charging infrastructure. As a result, the EV DC Fast Charger Market is likely to experience accelerated growth, driven by favorable regulatory environments and financial support aimed at enhancing the accessibility of charging solutions.

Consumer Demand for Convenience and Speed

Consumer demand for convenience and speed is a driving force behind the EV DC Fast Charger Market. As electric vehicle owners seek quick and efficient charging solutions, the need for fast chargers becomes increasingly apparent. In 2025, surveys indicate that a significant percentage of EV owners prioritize charging speed when selecting charging stations, with many expressing a preference for chargers that can deliver a full charge in under 30 minutes. This demand for rapid charging options is likely to influence the development and deployment of DC fast chargers across various locations, including urban areas and highways. Consequently, the EV DC Fast Charger Market is expected to grow as stakeholders respond to consumer preferences, ensuring that charging infrastructure meets the expectations of a rapidly evolving market.

Expansion of Commercial Charging Networks

The expansion of commercial charging networks is a vital driver for the EV DC Fast Charger Market. Businesses, including retail chains, parking facilities, and fleet operators, are increasingly recognizing the importance of providing charging solutions to attract customers and support their electric vehicle fleets. By 2025, it is projected that the number of commercial charging stations will increase significantly, with many businesses investing in fast chargers to enhance customer experience and operational efficiency. This trend not only facilitates the growth of the EV DC Fast Charger Market but also encourages collaboration between private and public sectors to create a comprehensive charging ecosystem. As more commercial entities adopt fast charging solutions, the overall infrastructure for electric vehicles will become more robust and accessible.

Technological Innovations in Charging Solutions

Technological innovations are transforming the EV DC Fast Charger Market, leading to more efficient and user-friendly charging solutions. Advances in charging technology, such as ultra-fast charging capabilities and smart charging systems, are enhancing the overall charging experience for consumers. In 2025, the introduction of chargers capable of delivering over 350 kW is expected to become more prevalent, significantly reducing charging times. Additionally, the integration of renewable energy sources into charging stations is gaining traction, aligning with sustainability goals. These innovations not only improve the performance of charging stations but also attract investments in the EV DC Fast Charger Market, as stakeholders seek to capitalize on cutting-edge technologies that meet the evolving needs of electric vehicle users.