Geopolitical Tensions

Geopolitical tensions in various regions are influencing the US Fast Attack Craft Market. The need for a rapid response capability in potential conflict zones has prompted the US Navy to enhance its fleet of fast attack crafts. As regional threats escalate, the demand for versatile vessels capable of conducting a range of missions, from surveillance to strike operations, is likely to increase. The US Fast Attack Craft Market may see a shift towards more adaptable designs that can operate effectively in diverse environments. This evolving landscape suggests that the industry must remain agile to meet the changing demands of national security.

Environmental Regulations

Environmental regulations are becoming an increasingly important consideration for the US Fast Attack Craft Market. As the US government implements stricter environmental policies, manufacturers are compelled to develop vessels that comply with these regulations. This may involve the adoption of cleaner propulsion technologies and materials that reduce the environmental impact of fast attack crafts. The push for sustainability could drive innovation within the industry, leading to the creation of more efficient and eco-friendly vessels. As a result, the US Fast Attack Craft Market may experience a transformation that aligns with broader environmental goals while maintaining operational effectiveness.

Focus on Coastal Security

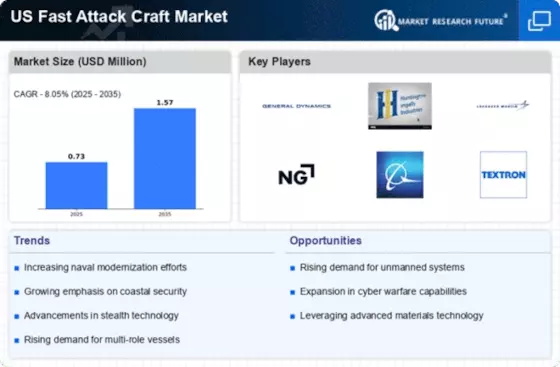

The growing emphasis on coastal security is a critical driver for the US Fast Attack Craft Market. As threats from piracy, smuggling, and other illicit activities increase along US coastlines, the demand for agile and versatile fast attack crafts is likely to rise. The US Coast Guard and Navy are prioritizing the development of vessels that can effectively patrol and secure coastal waters. This focus on maritime security may lead to increased collaboration between military and law enforcement agencies, further driving the need for advanced fast attack crafts. Consequently, the US Fast Attack Craft Market is poised to expand as it adapts to these evolving security challenges.

Increased Defense Spending

In recent years, the US government has significantly increased defense spending, which has a direct impact on the US Fast Attack Craft Market. The 2025 defense budget allocated substantial funds for naval modernization programs, including the procurement of new fast attack crafts. This increase in funding is likely to enhance the capabilities of the US Navy, allowing for the acquisition of advanced vessels equipped with state-of-the-art technologies. Furthermore, the emphasis on maintaining maritime superiority in contested environments suggests that the US Fast Attack Craft Market will continue to benefit from this upward trend in defense expenditure, potentially leading to a more robust and capable fleet.

Technological Advancements

The US Fast Attack Craft Market is experiencing a notable transformation driven by rapid technological advancements. Innovations in stealth technology, weapon systems, and propulsion methods are enhancing the operational capabilities of fast attack crafts. For instance, the integration of advanced radar and sensor systems allows for improved situational awareness and target acquisition. The US Navy's investment in unmanned systems and artificial intelligence is also reshaping the landscape, potentially leading to more efficient and effective maritime operations. As these technologies evolve, they may significantly influence procurement strategies and operational doctrines within the US Fast Attack Craft Market, suggesting a shift towards more sophisticated and capable vessels.