Integration with IoT and Edge Computing

The integration of Internet of Things (IoT) devices and edge computing technologies is significantly influencing the virtual router market in Europe. As the number of connected devices continues to rise, the demand for efficient data processing and routing at the edge becomes increasingly critical. Virtual routers facilitate this by enabling localized data management, thereby reducing latency and enhancing overall network performance. Industry reports indicate that the European IoT market is expected to reach €1 trillion by 2025, which underscores the potential for virtual routers to play a crucial role in managing the associated network traffic. This integration not only enhances operational efficiency but also positions the virtual router market as a key enabler of future technological advancements.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the virtual router market across Europe. Organizations are increasingly recognizing the financial benefits associated with deploying virtual routers, which often require lower capital expenditures compared to traditional hardware routers. The ability to optimize resources and reduce operational costs is particularly appealing in a competitive landscape. Recent analyses suggest that companies can achieve savings of up to 30% by transitioning to virtualized networking solutions. This trend is further fueled by the growing emphasis on operational efficiency, as businesses strive to maximize their return on investment. Consequently, the virtual router market in Europe is likely to see sustained growth as more organizations seek to leverage cost-effective networking solutions.

Regulatory Compliance and Data Sovereignty

Regulatory compliance and data sovereignty are becoming increasingly important drivers for the virtual router market in Europe. With stringent regulations such as the General Data Protection Regulation (GDPR) in place, organizations are compelled to ensure that their networking solutions adhere to legal requirements regarding data handling and storage. This has led to a heightened focus on virtual routers that offer robust security features and compliance capabilities. As businesses navigate the complexities of regulatory landscapes, the demand for virtual routers that can facilitate compliance is likely to grow. The virtual router market in Europe is thus positioned to expand as organizations prioritize solutions that align with regulatory standards while maintaining operational efficiency.

Rising Demand for Flexible Networking Solutions

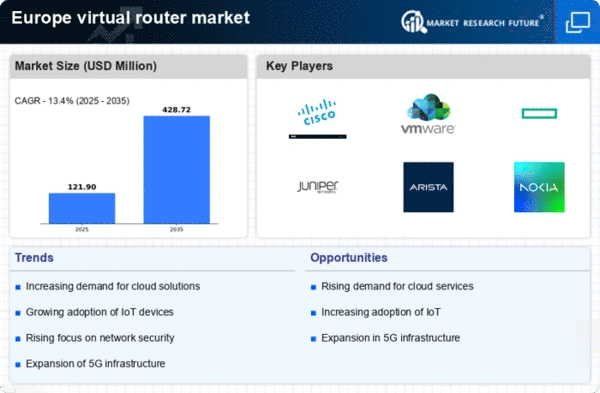

The virtual router market in Europe experiences a notable surge in demand for flexible networking solutions. Organizations are increasingly seeking to adapt their network infrastructures to accommodate dynamic workloads and varying traffic patterns. This shift is driven by the need for scalability and agility in network management. According to recent data, the European virtual router market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader trend where businesses prioritize solutions that can seamlessly integrate with existing systems while providing the flexibility to scale operations. As enterprises continue to embrace digital transformation, the virtual router market is likely to benefit from this increasing demand for adaptable networking solutions.

Advancements in Network Virtualization Technologies

Advancements in network virtualization technologies are driving innovation within the virtual router market in Europe. The emergence of new technologies, such as Network Functions Virtualization (NFV) and enhanced software-defined networking capabilities, is reshaping how organizations approach network management. These advancements enable businesses to deploy virtual routers that are not only more efficient but also capable of supporting a wider range of applications. As organizations increasingly adopt these technologies, the virtual router market is expected to witness substantial growth. Industry forecasts suggest that the market could expand by over 20% in the coming years, reflecting the growing recognition of the benefits associated with advanced virtualization solutions.