Advancements in 5G Technology

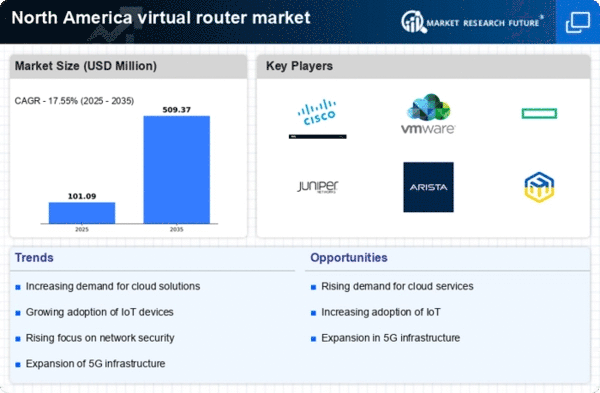

The advent of 5G technology is poised to reshape the virtual router market in North America. With its promise of ultra-fast data speeds and low latency, 5G enables new applications and services that require robust networking capabilities. Virtual routers are well-suited to handle the increased bandwidth demands associated with 5G networks. Industry forecasts suggest that the 5G market will reach $700 billion by 2025, creating a substantial opportunity for virtual router solutions. This technological advancement indicates that the virtual router market is likely to experience significant growth as businesses seek to leverage the benefits of 5G connectivity.

Increased Focus on Network Security

The virtual router market in North America is significantly influenced by the heightened focus on network security. As cyber threats become more sophisticated, organizations are compelled to adopt advanced security measures. Virtual routers provide enhanced security features, such as encryption and traffic segmentation, which are essential for protecting sensitive data. Recent data indicates that cybercrime costs businesses over $1 trillion annually, prompting a shift towards secure networking solutions. This growing emphasis on security is likely to drive the demand for virtual routers, as organizations prioritize safeguarding their networks against potential threats.

Shift Towards Remote Work Solutions

The virtual router market in North America is positively impacted by the ongoing shift towards remote work solutions. As organizations adapt to flexible work environments, the need for secure and reliable network access becomes paramount. Virtual routers facilitate secure connections for remote employees, ensuring seamless access to corporate resources. Recent surveys indicate that approximately 70% of companies plan to maintain remote work policies, which underscores the necessity for advanced networking solutions. This trend suggests that the virtual router market will continue to thrive as businesses invest in technologies that support remote work infrastructure.

Rising Demand for Network Virtualization

The virtual router market in North America experiences a notable surge in demand for network virtualization solutions. Organizations are increasingly seeking to optimize their network infrastructure, which leads to a shift from traditional hardware-based routers to virtual routers. This transition is driven by the need for flexibility, scalability, and cost efficiency. According to industry reports, the market for network virtualization is projected to grow at a CAGR of approximately 25% over the next five years. As businesses aim to enhance their operational efficiency, the adoption of virtual routers becomes a strategic imperative, thereby propelling the virtual router market forward.

Growth of Internet of Things (IoT) Devices

The proliferation of IoT devices in North America significantly influences the virtual router market. With millions of devices connecting to networks, the demand for efficient routing solutions escalates. Virtual routers offer the necessary capabilities to manage the increased data traffic generated by IoT applications. As per recent statistics, the number of connected IoT devices is expected to reach 30 billion by 2025, creating a substantial need for robust networking solutions. This trend indicates that the virtual router market is likely to expand as organizations seek to accommodate the complexities associated with IoT connectivity.