Expansion of Internet Connectivity

The expansion of internet connectivity across South America significantly influences the virtual router market. As more regions gain access to high-speed internet, the demand for efficient routing solutions increases. This trend is particularly evident in rural and underserved areas, where improved connectivity is essential for economic development. The virtual router market in South America is poised to benefit from this expansion, as businesses seek to optimize their network performance in response to growing user demands. With an estimated 60% of the population now online, the need for robust and scalable networking solutions is more pressing than ever, driving the adoption of virtual routers.

Cost Efficiency in Network Management

Cost efficiency remains a pivotal driver in the virtual router market in South America. Organizations are increasingly recognizing the financial benefits of deploying virtual routers over traditional hardware-based solutions. By leveraging virtual routers, companies can reduce capital expenditures associated with purchasing and maintaining physical devices. Furthermore, operational costs are minimized due to simplified management and reduced energy consumption. Reports indicate that businesses can save up to 30% on networking costs by transitioning to virtual solutions. This financial incentive is compelling many South American enterprises to adopt virtual routers, thereby accelerating market growth and fostering a competitive landscape.

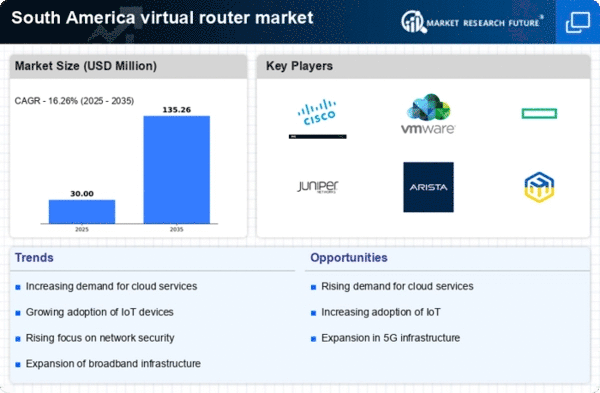

Rising Demand for Network Flexibility

The virtual router market in South America experiences a notable surge in demand for network flexibility. Businesses are increasingly seeking solutions that allow for rapid adjustments to network configurations without the need for extensive hardware changes. This flexibility is particularly crucial for enterprises that operate in dynamic environments, where the ability to scale services up or down can lead to significant cost savings. According to recent data, the market for virtual routers in South America is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for agile networking solutions that can adapt to changing business requirements, thereby enhancing operational efficiency and reducing downtime.

Integration with Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into networking solutions is a key driver for the virtual router market in South America. These technologies enhance the capabilities of virtual routers, enabling smarter traffic management and improved network performance. As organizations increasingly adopt AI-driven solutions, the demand for virtual routers that can seamlessly integrate with these technologies is expected to rise. This trend not only improves operational efficiency but also enhances security measures, making virtual routers a preferred choice for businesses looking to future-proof their networks. The market is likely to see a significant uptick in adoption rates as these integrations become more prevalent.

Regulatory Support for Digital Transformation

Regulatory support for digital transformation initiatives in South America plays a crucial role in driving the virtual router market. Governments across the region are implementing policies that encourage the adoption of digital technologies, including cloud computing and virtualization. This regulatory environment fosters innovation and investment in networking solutions, as businesses seek to comply with new standards and leverage available incentives. The virtual router market is expected to benefit from these supportive measures, as organizations look to modernize their infrastructure and enhance their digital capabilities. With an increasing number of regulations promoting digitalization, the market is likely to witness accelerated growth in the coming years.