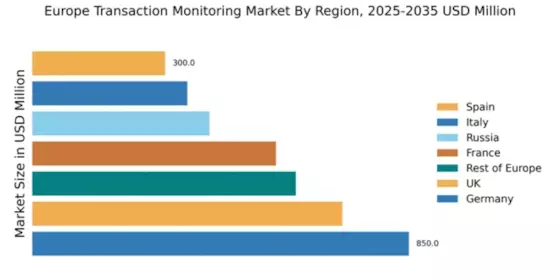

Germany : Robust Growth and Innovation Hub

Germany holds a dominant position in the European transaction monitoring market, accounting for approximately 30% of the total market share with a value of $850.0 million. Key growth drivers include stringent regulatory frameworks, such as the Anti-Money Laundering Act, which compel financial institutions to enhance their monitoring capabilities. The demand for advanced analytics and AI-driven solutions is rising, driven by increasing cyber threats and the need for compliance. Infrastructure investments in fintech are also bolstering market growth.

UK : Innovation and Compliance at Forefront

The UK transaction monitoring market is valued at $700.0 million, representing about 25% of the European market. Growth is fueled by the Financial Conduct Authority's (FCA) emphasis on compliance and the increasing sophistication of financial crimes. The demand for real-time monitoring solutions is surging, particularly in London, a global financial hub. The UK government is also investing in technology to enhance cybersecurity measures, further driving market expansion.

France : Strong Regulatory Environment Drives Growth

France's transaction monitoring market is valued at $550.0 million, capturing around 20% of the European market. The growth is primarily driven by the implementation of the PACTE law, which encourages transparency and compliance in financial transactions. Demand for integrated solutions that combine compliance and risk management is on the rise, particularly in Paris and Lyon. The French government is actively promoting digital transformation in finance, enhancing the market landscape.

Russia : Regulatory Changes Shape Landscape

Russia's transaction monitoring market is valued at $400.0 million, accounting for about 15% of the European market. Key growth drivers include recent regulatory changes aimed at combating money laundering and terrorist financing. Demand for localized solutions is increasing, particularly in Moscow and St. Petersburg, where financial institutions are adapting to new compliance requirements. However, geopolitical factors and economic sanctions pose challenges to market stability.

Italy : Focus on Compliance and Innovation

Italy's transaction monitoring market is valued at $350.0 million, representing approximately 12% of the European market. Growth is driven by the implementation of the EU's 5th Anti-Money Laundering Directive, which mandates enhanced monitoring practices. Demand for user-friendly solutions is increasing, especially in Milan and Rome, where financial institutions are investing in technology to meet compliance standards. The Italian government is also promoting fintech innovation to support market growth.

Spain : Regulatory Focus Fuels Demand

Spain's transaction monitoring market is valued at $300.0 million, capturing about 10% of the European market. The growth is driven by the Bank of Spain's initiatives to strengthen anti-money laundering measures. Demand for cloud-based solutions is rising, particularly in Madrid and Barcelona, as businesses seek to enhance their compliance capabilities. The Spanish government is also fostering a supportive environment for fintech startups, which is expected to drive further market expansion.

Rest of Europe : Regional Growth Opportunities Abound

The Rest of Europe transaction monitoring market is valued at $594.9 million, accounting for about 18% of the total market. Growth is driven by varying regulatory frameworks across countries, with some regions adopting stringent compliance measures. Demand for tailored solutions is increasing, particularly in Nordic countries and Eastern Europe, where local players are emerging. The competitive landscape includes both global and regional firms, creating a dynamic business environment.