Growing Awareness of Data Privacy

The growing awareness of data privacy among consumers and businesses is driving the security analytics market in Europe. As data breaches become more prevalent, organizations are increasingly prioritizing the protection of sensitive information. This heightened awareness is leading to greater investments in security analytics solutions that can help identify and mitigate risks associated with data handling. In 2025, it is estimated that 70% of European consumers will consider data privacy a critical factor when choosing service providers. Consequently, the security analytics market is experiencing a surge in demand for solutions that not only enhance security but also build consumer trust. As organizations strive to meet these expectations, the focus on security analytics is expected to intensify.

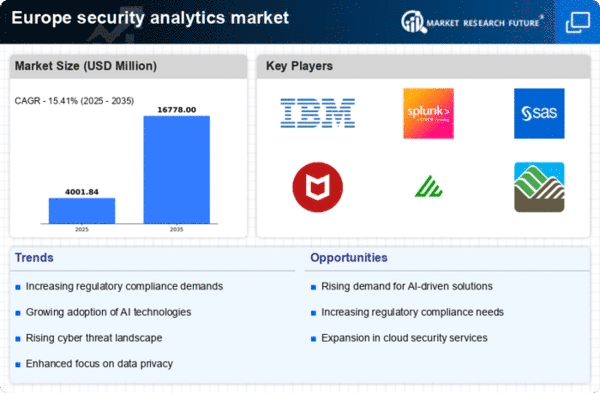

Increasing Cyber Threat Landscape

The escalating cyber threat landscape in Europe is a primary driver for the security analytics market. As organizations face a growing number of sophisticated cyberattacks, the demand for advanced security analytics solutions intensifies. In 2025, it is estimated that cybercrime will cost European businesses over €1 trillion annually, highlighting the urgent need for effective security measures. This environment compels organizations to invest in security analytics to detect, analyze, and respond to threats in real-time. The security analytics market is thus witnessing a surge in demand for solutions that can provide comprehensive visibility and actionable insights into potential vulnerabilities. As a result, companies are increasingly prioritizing investments in security analytics to safeguard their digital assets and maintain customer trust.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is reshaping the security analytics market. These technologies enable organizations to automate threat detection and response, significantly enhancing their security capabilities. In Europe, the adoption of AI-driven security analytics solutions is projected to grow at a CAGR of over 25% from 2025 to 2030. This growth is indicative of the increasing reliance on data-driven insights to combat cyber threats. The security analytics market is thus benefiting from innovations that allow for more efficient data processing and analysis, enabling organizations to stay ahead of potential threats. As businesses recognize the value of these technologies, investments in security analytics are expected to rise, further propelling market growth.

Regulatory Pressures and Compliance Requirements

Regulatory pressures in Europe are significantly influencing the security analytics market. With stringent regulations such as the General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive, organizations are compelled to adopt robust security analytics solutions. Compliance with these regulations not only helps in avoiding hefty fines, which can reach up to €20 million or 4% of annual global turnover, but also enhances overall security posture. The security analytics market is thus experiencing growth as businesses seek to implement solutions that ensure compliance while effectively managing risks. This trend is likely to continue as regulatory bodies evolve their frameworks to address emerging threats, further driving the demand for security analytics.

Rising Demand for Cloud-Based Security Solutions

The shift towards cloud-based security solutions is a significant driver for the security analytics market in Europe. As organizations increasingly migrate their operations to the cloud, the need for effective security measures to protect cloud environments becomes paramount. The cloud security market is projected to reach €30 billion by 2026, with a substantial portion attributed to security analytics solutions. This trend indicates a growing recognition of the importance of securing cloud infrastructures against potential threats. The security analytics market is thus witnessing heightened demand for solutions that can provide visibility and control over cloud-based assets. As businesses seek to enhance their security posture in the cloud, investments in security analytics are likely to continue to rise.