Growing Demand for IoT Connectivity

The burgeoning Internet of Things (IoT) ecosystem is driving demand for reliable connectivity solutions, thereby impacting the commercial satellite-broadband market. As more devices become interconnected, the need for consistent and widespread internet access becomes critical. In Europe, the number of IoT devices is projected to reach over 30 billion by 2025, necessitating robust communication networks. Satellite broadband can provide the necessary coverage for IoT applications in remote and rural areas, where terrestrial networks may be inadequate. This growing demand for IoT connectivity is likely to create new opportunities for satellite service providers, further propelling the commercial satellite-broadband market.

Increased Focus on Remote Work Solutions

The shift towards remote work solutions has created a heightened demand for reliable internet access, propelling the commercial satellite-broadband market forward. As businesses adapt to flexible work arrangements, the need for consistent and high-speed internet connectivity has become paramount. In Europe, it is estimated that around 40% of the workforce is engaged in remote work, necessitating robust broadband solutions. Satellite broadband offers a viable alternative for employees in remote locations, ensuring they remain connected. This trend is likely to continue, as companies recognize the benefits of remote work, further stimulating demand for satellite broadband services.

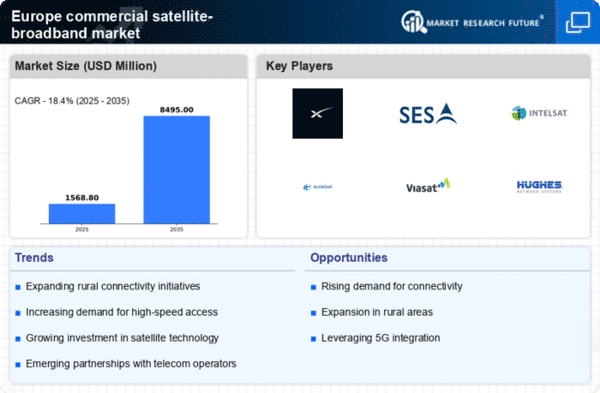

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed internet connectivity across various sectors in Europe is a primary driver for the commercial satellite-broadband market. Businesses, educational institutions, and healthcare facilities are seeking reliable and fast internet solutions to support their operations. According to recent data, approximately 30% of European households still lack access to high-speed broadband, creating a substantial market opportunity. The commercial satellite-broadband market is poised to fill this gap, particularly in rural and underserved areas where traditional infrastructure is lacking. As more users migrate to online platforms for work and education, the need for robust satellite solutions becomes more pronounced, potentially leading to a surge in market growth and investment in satellite technologies.

Government Initiatives for Digital Inclusion

Government initiatives aimed at promoting digital inclusion are playing a crucial role in the commercial satellite-broadband market. Various European governments are implementing policies to ensure that all citizens have access to high-speed internet, particularly in rural and remote areas. For example, the European Commission has set ambitious targets to connect all households to broadband by 2025. Such initiatives often include funding for satellite broadband projects, which can bridge the connectivity gap where traditional infrastructure is insufficient. This supportive regulatory environment is likely to enhance the growth prospects of the commercial satellite-broadband market in Europe.

Technological Advancements in Satellite Systems

Technological advancements in satellite systems are significantly influencing the commercial satellite-broadband market. Innovations such as high-throughput satellites (HTS) and low Earth orbit (LEO) satellite constellations are enhancing the capacity and efficiency of satellite communications. These advancements allow for higher data rates and lower latency, making satellite broadband more competitive with terrestrial options. For instance, the deployment of LEO satellites is expected to reduce latency to as low as 20 ms, which is comparable to fiber-optic networks. This technological evolution is likely to attract new customers and expand service offerings, thereby driving growth in the commercial satellite-broadband market in Europe.