Rising Carbon Pricing Mechanisms

The implementation of carbon pricing mechanisms across Europe is influencing the landfill gas market. As countries adopt carbon taxes and cap-and-trade systems, the financial implications of greenhouse gas emissions are becoming more pronounced. This trend encourages waste management companies to invest in landfill gas recovery technologies, as capturing and utilizing methane can significantly reduce their carbon footprint. In 2025, it is anticipated that carbon pricing will become more stringent, potentially increasing the cost of emissions by up to €50 per ton. Consequently, the landfill gas market may experience accelerated growth as companies seek to mitigate costs and comply with evolving environmental regulations.

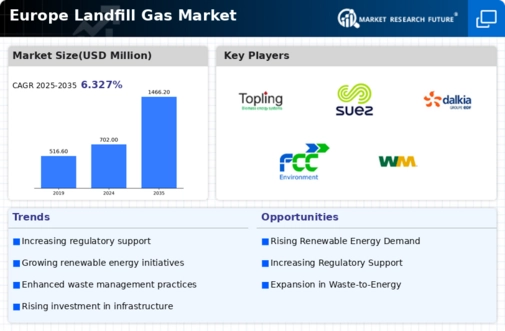

Enhanced Waste Management Practices

The evolution of waste management practices in Europe is driving growth in the landfill gas market. With stricter regulations on waste disposal and a growing emphasis on sustainability, many countries are adopting advanced waste management techniques. For instance, the European Union's Circular Economy Action Plan aims to reduce landfill waste by 10% by 2035, promoting recycling and recovery. This shift not only minimizes waste but also enhances the potential for landfill gas recovery. As a result, the landfill gas market is likely to see increased investments in technologies that capture methane emissions from landfills, thereby converting waste into a valuable energy resource.

Growing Demand for Renewable Energy

The increasing demand for renewable energy sources in Europe is a pivotal driver for the landfill gas market. As countries strive to meet their renewable energy targets, landfill gas, which is a byproduct of waste decomposition, is being recognized as a viable energy source. In 2023, renewable energy accounted for approximately 38% of the total energy consumption in the European Union, with landfill gas contributing a notable share. This trend is likely to continue, as the European Commission aims for at least 40% of energy to come from renewable sources by 2030. The landfill gas market stands to benefit significantly from this shift, as municipalities and waste management companies increasingly invest in infrastructure to capture and utilize landfill gas for energy production.

Public and Private Sector Collaboration

Collaboration between public and private sectors is emerging as a significant driver for the landfill gas market. Partnerships between governments, waste management companies, and energy producers are facilitating the development of innovative solutions for landfill gas utilization. For example, joint ventures have been established to create landfill gas-to-energy projects that benefit from shared expertise and resources. This collaborative approach is likely to enhance the efficiency of landfill gas recovery and utilization, ultimately leading to increased energy production from waste. As the European Union continues to promote sustainable practices, such collaborations are expected to play a vital role in advancing the landfill gas market.

Investment in Infrastructure Development

Investment in infrastructure development is a crucial driver for the landfill gas market in Europe. Governments and private entities are increasingly allocating funds to enhance landfill gas collection and utilization systems. In 2024, it was reported that investments in waste-to-energy projects, including landfill gas facilities, reached approximately €1.5 billion across Europe. This trend is expected to continue, as the European Green Deal emphasizes the importance of sustainable waste management and energy production. Enhanced infrastructure not only improves the efficiency of landfill gas recovery but also supports the transition towards a circular economy, thereby fostering growth in the landfill gas market.