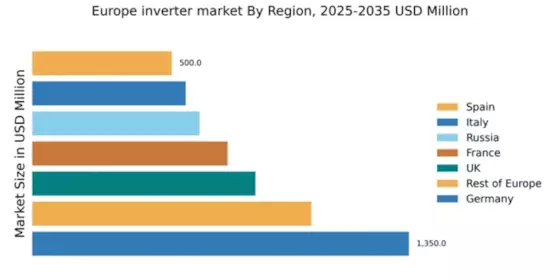

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 27% in the European inverter market, valued at $1,350.0 million. Key growth drivers include robust government incentives for renewable energy, particularly the Renewable Energy Sources Act (EEG), which promotes solar energy adoption. The increasing demand for energy-efficient solutions and the shift towards decentralized energy systems are also significant trends. Infrastructure investments in solar parks and residential installations further bolster market growth.

UK : Government Support Fuels Market Expansion

The UK inverter market is valued at $800.0 million, accounting for 16% of the European market. Growth is driven by government initiatives like the Feed-in Tariff (FiT) and the Smart Export Guarantee (SEG), which incentivize solar energy production. Increasing consumer awareness and demand for sustainable energy solutions are also notable trends. The UK is witnessing a rise in solar installations, particularly in residential areas, supported by favorable regulatory frameworks.

France : Diverse Applications Drive Demand

France's inverter market is valued at $700.0 million, representing 14% of the European market. The growth is fueled by government policies promoting renewable energy, including the Multiannual Energy Program (PPE). Demand for inverters is rising in both residential and commercial sectors, with a focus on energy independence. The French market is characterized by a diverse range of applications, from solar farms to rooftop installations, enhancing consumption patterns.

Russia : Potential for Growth in Renewables

The Russian inverter market is valued at $600.0 million, making up 12% of the European market. Key growth drivers include increasing government interest in renewable energy and the potential for solar energy in southern regions. Demand is gradually rising, particularly in areas like Krasnodar and Rostov, where solar resources are abundant. However, regulatory challenges and infrastructure development remain critical for market expansion.

Italy : Strong Incentives Boost Adoption

Italy's inverter market is valued at $550.0 million, representing 11% of the European market. The growth is supported by government incentives such as the Conto Energia program, which encourages solar energy adoption. Demand trends show a shift towards high-efficiency inverters, particularly in regions like Lombardy and Sicily. The competitive landscape includes major players like Enphase and SMA, contributing to a dynamic business environment.

Spain : Regulatory Changes Spark Growth

Spain's inverter market is valued at $500.0 million, accounting for 10% of the European market. The revival of the solar sector is driven by regulatory changes, including the elimination of the sun tax and new incentives for solar installations. Demand is increasing in regions like Andalusia and Catalonia, where solar potential is high. The competitive landscape features key players like SolarEdge and Fronius, enhancing market dynamics.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe inverter market is valued at $1,000.0 million, representing 20% of the European market. Growth drivers vary by country, with some regions focusing on solar energy while others explore wind and hydroelectric solutions. Demand trends reflect a mix of residential and commercial applications, influenced by local regulations and incentives. Countries like the Netherlands and Belgium are emerging as key players in the inverter market.