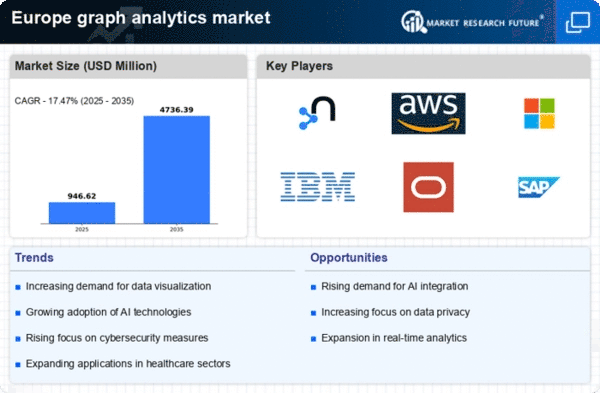

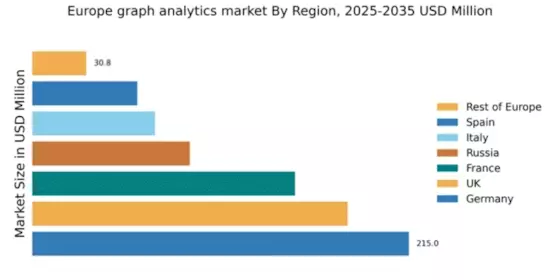

Germany : Strong Market Growth and Innovation

Germany holds a dominant position in the European graph analytics market, with a market value of $215.0 million, representing approximately 30.5% of the total market share. Key growth drivers include a robust industrial base, increasing demand for data-driven decision-making, and government initiatives promoting digital transformation. The country’s regulatory framework supports innovation, while investments in infrastructure enhance connectivity and data accessibility.

UK : Strong Demand Across Sectors

Key markets include London, Manchester, and Edinburgh, where a vibrant startup ecosystem thrives. Major players like Neo4j and AWS have established a strong presence, fostering competition. The local business environment is characterized by a collaborative approach between tech firms and academic institutions, driving sector-specific applications in finance and healthcare.

France : Government Support Fuels Growth

Key cities like Paris, Lyon, and Toulouse are central to market activities, with a competitive landscape featuring players like SAP and IBM. The business environment is conducive to tech startups, with numerous incubators and accelerators. Sector-specific applications are growing in logistics and smart city projects, enhancing the overall market dynamics.

Russia : Potential Amidst Regulatory Hurdles

Moscow and St. Petersburg are the primary markets, with a competitive landscape featuring local players and some international firms. The presence of companies like DataStax and Oracle indicates a growing interest in the region. The business environment is evolving, with increasing investments in sectors like telecommunications and energy, driving demand for graph analytics solutions.

Italy : Focus on Industrial Applications

Key markets include Milan, Turin, and Rome, where major players like SAP and IBM are actively engaged. The competitive landscape is characterized by a mix of local and international firms, fostering innovation. The business environment is improving, with a focus on industrial applications in manufacturing and logistics, driving demand for graph analytics solutions.

Spain : Rapid Adoption of Data Solutions

Key cities like Madrid and Barcelona are central to market activities, with a competitive landscape featuring both local and international players. Companies like Neo4j and Microsoft are establishing a presence, enhancing competition. The local business environment is characterized by a growing startup ecosystem, driving sector-specific applications in finance and telecommunications.

Rest of Europe : Varied Growth Across Regions

Countries like Belgium, Netherlands, and the Nordics are key players in this segment, with a competitive landscape featuring local startups and established firms. The presence of companies like ArangoDB indicates a growing interest in niche applications. The business environment varies significantly, with strong emphasis on sustainability and innovation in sectors like logistics and healthcare.