Advancements in GPU Technology

Technological advancements in GPU architecture are significantly influencing the Europe GPU Database Market. The introduction of more powerful and efficient GPUs allows for enhanced data processing capabilities, enabling organizations to manage larger datasets with greater speed and accuracy. Innovations such as NVIDIA's Ampere architecture and AMD's RDNA technology are setting new benchmarks for performance in data-intensive applications. These advancements not only improve the performance of GPU databases but also reduce operational costs, making them more accessible to a wider range of businesses. As a result, the market is likely to witness an influx of new entrants and increased competition, further driving innovation and adoption across Europe.

Rising Demand for Real-Time Data Processing

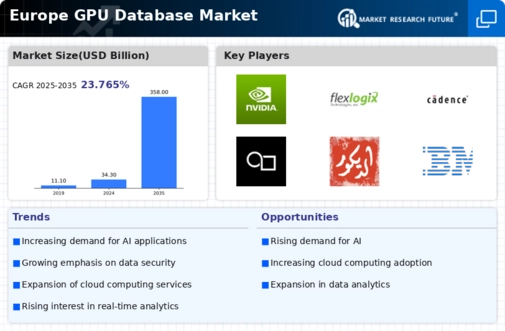

The Europe GPU Database Market is experiencing a notable surge in demand for real-time data processing capabilities. Organizations across various sectors, including finance, healthcare, and e-commerce, are increasingly relying on GPU databases to handle vast amounts of data efficiently. This trend is driven by the need for immediate insights and decision-making, which GPU databases facilitate through their parallel processing capabilities. According to recent estimates, the market for GPU databases in Europe is projected to grow at a compound annual growth rate (CAGR) of approximately 25% over the next five years. This growth is indicative of the industry's shift towards more agile data management solutions that can support real-time analytics and enhance operational efficiency.

Increased Investment in Cloud Infrastructure

The Europe GPU Database Market is witnessing increased investment in cloud infrastructure, which is facilitating the adoption of GPU databases. As organizations migrate to cloud-based solutions, the demand for scalable and efficient data management systems is rising. Cloud service providers are integrating GPU database capabilities into their offerings, allowing businesses to leverage the power of GPUs without significant upfront investments. This trend is reflected in the growing number of partnerships between cloud providers and GPU database vendors, which aim to deliver optimized solutions for data-intensive applications. The cloud adoption rate in Europe is projected to reach 80% by 2027, further driving the growth of the GPU database market as organizations seek to enhance their data processing capabilities.

Regulatory Support for Advanced Technologies

Regulatory frameworks in Europe are increasingly supportive of advanced technologies, which is positively impacting the Europe GPU Database Market. Initiatives such as the European Union's Digital Single Market strategy aim to foster innovation and enhance the digital economy. These policies encourage the adoption of cutting-edge technologies, including GPU databases, by providing funding and resources for research and development. Furthermore, compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), is driving organizations to seek more efficient data management solutions. As a result, the GPU database market is likely to benefit from a favorable regulatory environment that promotes technological advancement and data security.

Growing Emphasis on Data-Driven Decision Making

The Europe GPU Database Market is being propelled by a growing emphasis on data-driven decision making among enterprises. Organizations are increasingly recognizing the value of leveraging data analytics to gain competitive advantages. This shift is leading to higher investments in advanced data management solutions, including GPU databases, which are capable of processing complex queries and large datasets efficiently. A report indicates that over 70% of European companies are prioritizing data analytics in their strategic initiatives, thereby creating a robust demand for GPU databases. This trend is expected to continue, as businesses seek to harness the power of data to drive innovation and improve customer experiences.