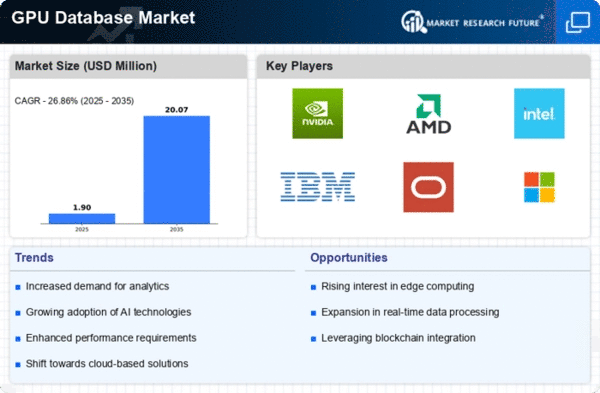

Market Growth Projections

The Global GPU Database Market Industry is poised for substantial growth, with projections indicating a market size of 99.1 USD Billion in 2024 and an anticipated increase to 1789.6 USD Billion by 2035. This represents a remarkable compound annual growth rate (CAGR) of 30.09% from 2025 to 2035. Such growth is indicative of the increasing reliance on GPU databases across various sectors, driven by advancements in technology, the rise of data analytics, and the integration of AI solutions. The market's trajectory suggests a robust future, reflecting the critical role of GPU databases in managing and processing vast amounts of data.

Advancements in GPU Technology

Technological advancements in GPU capabilities significantly influence the Global GPU Database Market Industry. The continuous evolution of GPU architecture, including improvements in parallel processing and memory bandwidth, enhances the performance of database systems. For instance, the introduction of new GPU models allows for faster query execution and improved data retrieval times. These advancements are expected to contribute to the market's growth, with projections indicating a remarkable increase to 1789.6 USD Billion by 2035. As organizations seek to harness the full potential of their data, the demand for advanced GPU databases is likely to escalate.

Rising Demand for Data Analytics

The Global GPU Database Market Industry experiences a surge in demand for data analytics solutions. Organizations across various sectors are increasingly leveraging data-driven insights to enhance decision-making processes. This trend is particularly evident in industries such as finance, healthcare, and retail, where real-time data processing is crucial. As a result, the market is projected to reach 99.1 USD Billion in 2024, reflecting a growing reliance on GPU databases for efficient data handling. The ability to process large datasets quickly and accurately is becoming a competitive advantage, thereby driving the adoption of GPU databases globally.

Increased Adoption of Cloud Computing

The Global GPU Database Market Industry is witnessing a notable shift towards cloud computing solutions. As businesses migrate to cloud platforms, the need for scalable and efficient database solutions becomes paramount. GPU databases offer enhanced performance for cloud-based applications, enabling organizations to process large volumes of data seamlessly. This trend is further supported by the increasing availability of cloud services that integrate GPU capabilities. The market's growth trajectory is expected to align with the broader cloud computing sector, which is projected to expand significantly in the coming years, thereby driving the adoption of GPU databases.

Regulatory Compliance and Data Security

The Global GPU Database Market Industry is also influenced by the growing emphasis on regulatory compliance and data security. Organizations are increasingly required to adhere to stringent data protection regulations, necessitating the implementation of secure database solutions. GPU databases offer enhanced security features, such as encryption and access controls, which are critical for safeguarding sensitive information. As data breaches become more prevalent, the demand for secure and compliant database systems is expected to rise. This focus on security not only drives the adoption of GPU databases but also ensures that organizations can meet regulatory requirements effectively.

Growing Importance of Artificial Intelligence

The integration of artificial intelligence (AI) technologies into various applications is a key driver for the Global GPU Database Market Industry. AI requires substantial computational power for training and inference processes, which GPU databases can provide efficiently. Industries such as automotive, healthcare, and finance are increasingly utilizing AI-driven solutions, necessitating robust database systems that can handle complex data structures. As AI adoption continues to rise, the demand for GPU databases is likely to increase, further propelling the market's growth. This trend aligns with the projected CAGR of 30.09% for the period from 2025 to 2035.