Advancements in GPU Technology

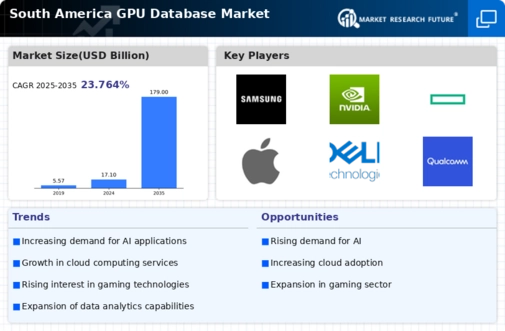

Technological advancements in GPU capabilities are significantly influencing the South America Gpu Database Market. The introduction of more powerful and efficient GPUs allows for faster data processing and improved performance in database management. For instance, the latest GPU architectures are designed to handle complex queries and large-scale data operations with greater efficiency. This is particularly relevant in sectors such as telecommunications and e-commerce, where rapid data processing is essential. As organizations in South America seek to optimize their operations, the integration of advanced GPU technology into database systems is likely to become a standard practice, further propelling market growth.

Growing Demand for Data Analytics

The South America Gpu Database Market is experiencing a surge in demand for data analytics solutions. As businesses increasingly recognize the value of data-driven decision-making, the need for efficient data processing and analysis tools becomes paramount. In 2025, the market for data analytics in South America was valued at approximately 3 billion USD, with projections indicating a compound annual growth rate of 15% through 2028. This growth is largely fueled by sectors such as finance, retail, and healthcare, which are leveraging GPU databases to enhance their analytical capabilities. The ability to process large datasets in real-time is becoming a competitive advantage, thereby driving the adoption of GPU databases across various industries in South America.

Emergence of Big Data Technologies

The emergence of big data technologies is significantly impacting the South America Gpu Database Market. As organizations generate and collect vast amounts of data, the need for efficient storage and processing solutions becomes critical. GPU databases are well-suited for big data applications due to their ability to handle large datasets and perform complex computations rapidly. In 2025, the big data market in South America was valued at approximately 4 billion USD, with expectations of continued growth. This trend is particularly relevant for industries such as logistics and transportation, where real-time data analysis is essential for operational efficiency. The integration of GPU databases into big data strategies is likely to enhance data management capabilities across the region.

Focus on Enhanced Security Measures

Security concerns are becoming increasingly prominent in the South America Gpu Database Market. As data breaches and cyber threats continue to rise, organizations are prioritizing the implementation of robust security measures within their database systems. GPU databases are being recognized for their ability to process and analyze data securely, which is crucial for industries such as finance and healthcare. In 2025, it was reported that over 60% of companies in South America were investing in advanced security solutions for their data management systems. This focus on security is likely to drive the adoption of GPU databases, as organizations seek to protect sensitive information while maintaining high performance.

Increase in Cloud Computing Adoption

The rise of cloud computing services is reshaping the South America Gpu Database Market. As businesses migrate to cloud-based solutions, the demand for GPU databases that can efficiently handle large volumes of data in the cloud is increasing. In 2025, the cloud computing market in South America was estimated to be worth around 5 billion USD, with a significant portion allocated to data management solutions. This trend is particularly evident among small and medium-sized enterprises (SMEs) that are leveraging cloud services to enhance their operational efficiency. The flexibility and scalability offered by cloud-based GPU databases are likely to attract more organizations, thereby driving market expansion.