Rise of Edge Computing

The rise of edge computing is significantly influencing the North America GPU Database Market. As more devices become interconnected through the Internet of Things (IoT), the need for processing data closer to the source is becoming paramount. Edge computing reduces latency and bandwidth usage, making it an ideal complement to GPU databases. Organizations are increasingly deploying GPU databases at the edge to facilitate real-time data processing and analytics. This trend is expected to accelerate the adoption of GPU databases, as businesses recognize the advantages of leveraging edge computing to enhance their operational capabilities. The market is likely to see a shift towards solutions that integrate edge computing with GPU database technologies.

Advancements in GPU Technology

Technological advancements in GPU architecture are playing a pivotal role in the North America GPU Database Market. The introduction of more powerful and efficient GPUs enables faster data processing and improved performance for database operations. Innovations such as parallel processing and enhanced memory bandwidth allow organizations to handle larger datasets with ease. As a result, companies are increasingly investing in GPU databases to leverage these advancements, which can lead to significant cost savings and improved analytical capabilities. The market is expected to witness a substantial increase in adoption rates as organizations recognize the potential of cutting-edge GPU technology to transform their data management practices.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are becoming increasingly critical in the North America GPU Database Market. With stringent regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), organizations are compelled to adopt robust data management solutions. GPU databases offer enhanced security features and compliance capabilities, making them an attractive option for businesses looking to meet regulatory requirements. As organizations prioritize data governance, the demand for GPU databases is likely to rise, as these solutions provide the necessary tools to manage and protect sensitive information effectively. This trend is expected to drive growth in the market as companies seek to mitigate risks associated with non-compliance.

Increased Investment in Big Data Analytics

The North America GPU Database Market is benefiting from a heightened focus on big data analytics. Organizations are investing heavily in data analytics tools to extract valuable insights from their data. This trend is fueled by the growing recognition of data as a strategic asset. According to recent reports, the big data analytics market in North America is projected to reach over 200 billion USD by 2026. As businesses strive to remain competitive, the integration of GPU databases into their analytics frameworks is becoming increasingly common. This integration allows for faster processing of large datasets, enabling organizations to derive insights that drive strategic decision-making.

Growing Demand for Real-Time Data Processing

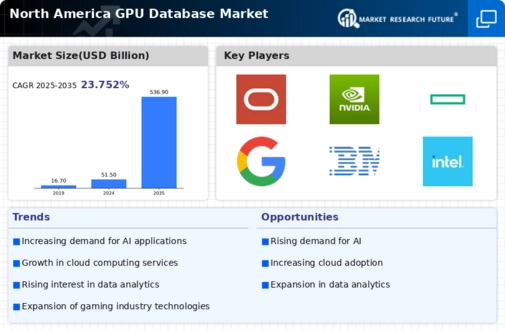

The North America GPU Database Market is experiencing a surge in demand for real-time data processing capabilities. Organizations across various sectors, including finance, healthcare, and retail, are increasingly relying on real-time analytics to make informed decisions. This trend is driven by the need for immediate insights from vast datasets, which traditional databases struggle to provide. The market for GPU databases is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 30% in the coming years. As businesses seek to enhance their operational efficiency and customer experiences, the adoption of GPU databases is likely to become a critical component of their data strategies.