Evolving Regulatory Frameworks

The cyber insurance market in Europe is influenced by the evolving regulatory landscape. This landscape mandates stricter data protection and cybersecurity measures. The General Data Protection Regulation (GDPR) has set a precedent for data privacy, compelling organizations to adopt robust cybersecurity practices. As compliance becomes a priority, businesses are increasingly turning to cyber insurance to mitigate risks associated with non-compliance. The potential fines for data breaches can reach up to €20 million or 4% of global turnover, making insurance a prudent investment. This regulatory pressure is likely to enhance the demand for tailored cyber insurance products, as companies seek to align their risk management strategies with legal requirements.

Increasing Cyber Threat Landscape

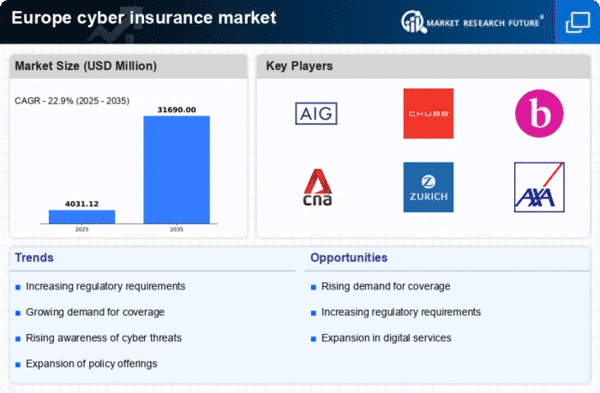

The cyber insurance market in Europe is experiencing growth. This growth is due to the escalating frequency and sophistication of cyber threats. As organizations face a myriad of cyber risks, including ransomware attacks and data breaches, the demand for comprehensive insurance solutions is rising. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting European companies to seek protection through cyber insurance. This trend indicates a shift in risk management strategies, as businesses recognize the necessity of safeguarding their digital assets. The increasing awareness of potential financial losses associated with cyber incidents is likely to drive the adoption of cyber insurance products, thereby expanding the market significantly.

Increased Awareness of Cyber Risks

The cyber insurance market in Europe is experiencing a surge in demand. This surge is due to heightened awareness of cyber risks among businesses. As incidents of cyberattacks become more prevalent in the media, organizations are increasingly recognizing the potential impact on their operations and finances. Surveys indicate that over 60% of European businesses consider cyber threats a top concern, leading to a greater inclination to invest in cyber insurance. This growing awareness is likely to drive the market as companies seek to protect themselves against potential losses. Insurers are responding by offering more comprehensive coverage options, tailored to the specific needs of various industries, thereby enhancing the attractiveness of cyber insurance products.

Growing Digital Transformation Initiatives

The cyber insurance market in Europe is benefiting from rapid digital transformation initiatives. These initiatives are being undertaken by various sectors. As organizations transition to digital platforms, they become more vulnerable to cyber threats, necessitating the need for insurance coverage. In 2025, it is projected that the digital economy will account for over 25% of Europe's GDP, underscoring the importance of securing digital assets. This shift towards digitalization is likely to drive the demand for cyber insurance, as businesses recognize the potential financial repercussions of cyber incidents. Consequently, insurers are developing innovative products to cater to the unique needs of digitally transformed organizations, further propelling market growth.

Technological Advancements in Risk Assessment

The cyber insurance market in Europe is being shaped by technological advancements. These advancements enhance risk assessment capabilities. Insurers are increasingly utilizing data analytics and artificial intelligence to evaluate the cyber risk profiles of organizations. This evolution allows for more accurate pricing of insurance products and tailored coverage options. As businesses become more aware of their unique risk exposures, they are likely to seek customized insurance solutions. The integration of advanced technologies in underwriting processes is expected to streamline operations and improve the overall efficiency of the cyber insurance market. This trend may lead to increased competition among insurers, ultimately benefiting consumers with better coverage options.