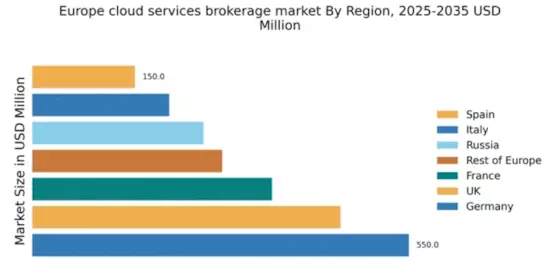

Germany : Strong Infrastructure and Innovation Hub

Key markets include major cities like Berlin, Munich, and Frankfurt, which are home to numerous tech startups and established enterprises. The competitive landscape features strong players such as SAP and AWS, alongside international giants like Microsoft Azure and Google Cloud. The local business environment is characterized by a focus on compliance with stringent data protection regulations, fostering a climate of trust and reliability in cloud services. Industries such as automotive, finance, and healthcare are rapidly adopting cloud solutions to enhance operational efficiency and innovation.

UK : Innovation and Investment Drive Growth

Key markets include London, Manchester, and Edinburgh, where a vibrant tech scene thrives. The competitive landscape is marked by the presence of major players like AWS, Microsoft Azure, and Google Cloud, alongside local firms. The business environment is conducive to growth, with a focus on fintech, e-commerce, and media sectors leveraging cloud technologies for scalability and agility. The UK’s regulatory framework also supports cloud adoption, ensuring data protection and compliance.

France : Strong Demand in Tech and Finance

Key markets include Paris, Lyon, and Toulouse, which are hubs for tech innovation and financial services. The competitive landscape features major players like AWS, Microsoft Azure, and local firms such as OVHcloud. The business environment is characterized by a strong focus on compliance with EU regulations, fostering trust in cloud services. Industries such as e-commerce and healthcare are increasingly adopting cloud solutions to improve service delivery and customer engagement.

Russia : Market Potential Amid Challenges

Key markets include Moscow and St. Petersburg, where a burgeoning tech ecosystem is emerging. The competitive landscape features both local players and international giants like AWS and Microsoft Azure. The business environment is complex, with a focus on compliance with local regulations and data sovereignty. Industries such as telecommunications and finance are increasingly adopting cloud solutions to drive innovation and improve service delivery.

Italy : Digital Transformation Accelerates Adoption

Key markets include Milan, Rome, and Turin, which are central to Italy's economic activities. The competitive landscape features major players like AWS, Microsoft Azure, and local firms such as Aruba. The business environment is evolving, with a focus on compliance with EU regulations and fostering innovation. Industries such as fashion and automotive are increasingly leveraging cloud solutions to enhance operational efficiency and customer engagement.

Spain : Emerging Market with High Potential

Key markets include Madrid and Barcelona, which are hubs for technology and innovation. The competitive landscape features major players like AWS, Microsoft Azure, and local firms. The business environment is characterized by a focus on compliance with EU regulations, fostering trust in cloud services. Industries such as e-commerce and logistics are increasingly adopting cloud solutions to improve service delivery and operational efficiency.

Rest of Europe : Varied Growth Opportunities and Challenges

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region, each with unique characteristics. The competitive landscape features a mix of local and international players, including AWS and Microsoft Azure. The business environment is shaped by varying regulatory requirements and market conditions, with industries such as logistics and telecommunications increasingly adopting cloud solutions to enhance operational efficiency and innovation.