Emphasis on Cost Efficiency

Cost efficiency remains a critical driver in the cloud services-brokerage market. Canadian businesses are increasingly focused on optimizing their IT expenditures, leading to a surge in the adoption of cloud solutions that promise reduced operational costs. Recent statistics indicate that organizations can save up to 30% on IT costs by leveraging cloud services through brokers. This financial incentive is prompting companies to explore various cloud options, including hybrid and multi-cloud environments. Consequently, brokers are adapting their service models to provide cost-effective solutions that align with clients' budgetary constraints. The emphasis on cost efficiency not only enhances the attractiveness of cloud services but also fosters a competitive landscape among brokers striving to deliver the best value to their customers.

Integration of Advanced Technologies

The integration of advanced technologies is significantly influencing the cloud services-brokerage market in Canada. As businesses seek to enhance their operational capabilities, the incorporation of artificial intelligence (AI), machine learning (ML), and automation into cloud services is becoming increasingly prevalent. This trend is evident as approximately 60% of Canadian firms are exploring AI-driven cloud solutions to improve efficiency and decision-making processes. Cloud service brokers are responding by offering innovative solutions that leverage these technologies, thereby enhancing their value proposition. The ability to provide advanced technological integrations positions brokers as key players in the digital landscape, enabling businesses to harness the full potential of cloud computing. This integration not only drives growth in the cloud services-brokerage market but also fosters a culture of innovation among Canadian enterprises.

Rising Demand for Scalable Solutions

The cloud services-brokerage market in Canada is experiencing a notable increase in demand for scalable solutions. Businesses are increasingly seeking flexible cloud services that can adapt to their changing needs. This trend is driven by the necessity for organizations to manage fluctuating workloads efficiently. According to recent data, approximately 70% of Canadian enterprises are prioritizing scalability in their cloud strategies. This shift is compelling cloud service brokers to offer tailored solutions that can accommodate varying levels of demand. As a result, the cloud services-brokerage market is likely to expand, with brokers enhancing their offerings to include more scalable options. This evolution not only supports businesses in optimizing their operations but also positions brokers as essential partners in the digital transformation journey.

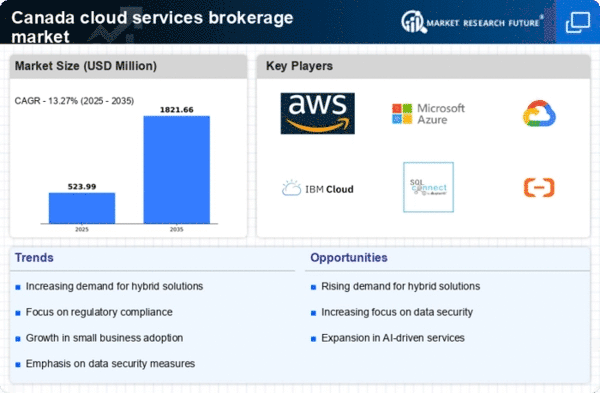

Growing Focus on Hybrid Cloud Solutions

The growing focus on hybrid cloud solutions is reshaping the cloud services-brokerage market in Canada. Organizations are increasingly recognizing the benefits of combining public and private cloud environments to optimize their IT infrastructure. Recent surveys indicate that nearly 65% of Canadian enterprises are adopting hybrid cloud strategies to enhance flexibility and control over their data. This trend is prompting cloud service brokers to develop comprehensive hybrid solutions that cater to diverse business needs. By offering tailored hybrid cloud services, brokers can help organizations achieve a balance between cost efficiency and data security. This shift towards hybrid solutions not only drives growth in the cloud services-brokerage market but also positions brokers as strategic partners in the evolving digital landscape.

Regulatory Compliance and Data Sovereignty

Regulatory compliance and data sovereignty are paramount concerns for Canadian businesses, significantly impacting the cloud services-brokerage market. With stringent data protection laws in place, organizations are increasingly prioritizing compliance when selecting cloud services. Recent findings suggest that over 75% of Canadian companies consider regulatory adherence a top priority in their cloud strategies. This focus on compliance is compelling cloud service brokers to ensure that their offerings align with local regulations, thereby enhancing trust and reliability. As a result, brokers are likely to invest in solutions that guarantee data sovereignty, ensuring that customer data remains within Canadian borders. This emphasis on regulatory compliance not only strengthens the cloud services-brokerage market but also fosters a secure environment for businesses to operate.