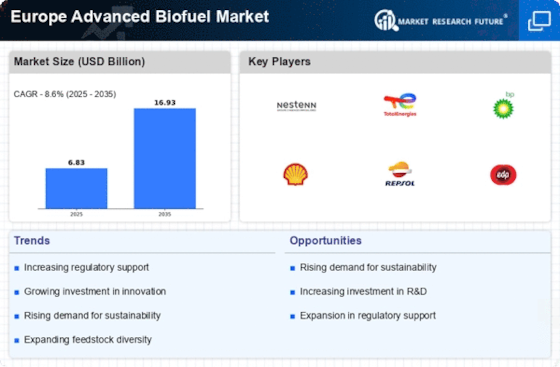

Consumer Demand for Sustainable Energy

The growing consumer demand for sustainable energy solutions is a pivotal driver for the Europe Advanced Biofuels Market. As awareness of climate change and environmental issues rises, consumers are increasingly seeking greener alternatives to traditional fossil fuels. This shift in consumer behavior is reflected in the rising sales of biofuels, which are perceived as more environmentally friendly. According to recent surveys, a significant percentage of European consumers express a willingness to pay a premium for sustainable energy options. This trend is prompting fuel suppliers and automotive manufacturers to explore partnerships with biofuel producers, thereby expanding the market. The increasing availability of biofuels at retail outlets and the integration of biofuels into existing fuel supply chains are likely to further enhance consumer access and acceptance, driving growth in the Europe Advanced Biofuels Market.

Technological Innovations in Production

Technological advancements play a crucial role in shaping the Europe Advanced Biofuels Market. Innovations in production processes, such as the development of second and third-generation biofuels, are enhancing efficiency and reducing costs. For example, the use of waste materials and non-food crops for biofuel production is gaining traction, which not only addresses food security concerns but also promotes sustainability. The European Commission has reported that investments in research and development for biofuel technologies have increased, leading to breakthroughs in conversion technologies. These innovations are expected to improve the overall competitiveness of advanced biofuels compared to fossil fuels. As a result, the market is likely to witness a surge in production capacity and a diversification of feedstock sources, further solidifying the position of the Europe Advanced Biofuels Market.

Investment in Infrastructure Development

Investment in infrastructure development is a critical factor propelling the Europe Advanced Biofuels Market. The establishment of production facilities, distribution networks, and refueling stations is essential for the widespread adoption of advanced biofuels. Governments and private investors are recognizing the need for substantial capital investment to build the necessary infrastructure to support biofuel production and distribution. For instance, several European countries are investing in biorefineries that convert biomass into advanced biofuels, which are strategically located to optimize supply chains. Additionally, the development of blending facilities that allow for the seamless integration of biofuels into existing fuel systems is gaining momentum. This infrastructure investment is expected to enhance the availability and accessibility of advanced biofuels, thereby stimulating market growth in the Europe Advanced Biofuels Market.

Regulatory Support and Policy Frameworks

The Europe Advanced Biofuels Market is significantly influenced by robust regulatory support and policy frameworks established by the European Union. The EU has set ambitious targets for renewable energy, aiming for at least 32% of its energy to come from renewable sources by 2030. This regulatory environment encourages investment in advanced biofuels, as member states implement national policies to meet these targets. For instance, the Renewable Energy Directive II mandates that a certain percentage of transport fuels must come from renewable sources, which directly benefits the advanced biofuels sector. Furthermore, financial incentives and subsidies for biofuel production are becoming increasingly common, fostering growth in the industry. This supportive policy landscape is likely to drive innovation and expansion within the Europe Advanced Biofuels Market.

Collaboration and Partnerships in Research

Collaboration and partnerships in research and development are emerging as vital drivers for the Europe Advanced Biofuels Market. Academic institutions, research organizations, and industry stakeholders are increasingly joining forces to advance biofuel technologies and address challenges related to production and sustainability. These collaborative efforts often lead to innovative solutions that enhance the efficiency and viability of advanced biofuels. For example, partnerships between universities and biofuel companies have resulted in breakthroughs in feedstock optimization and conversion processes. Furthermore, European funding programs, such as Horizon Europe, are supporting collaborative research initiatives aimed at fostering innovation in the biofuels sector. This collaborative approach is likely to accelerate the development of advanced biofuels, positioning the Europe Advanced Biofuels Market for sustained growth in the coming years.