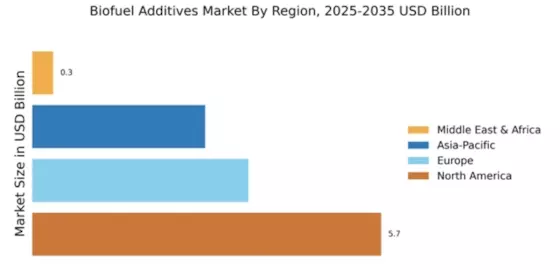

Market Growth Projections

The Global Biofuel Additives Market Industry is poised for substantial growth, with projections indicating a market value of 16.7 USD Billion in 2024 and an anticipated increase to 41.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.68% from 2025 to 2035, reflecting the increasing adoption of biofuels across various sectors. The expansion is driven by factors such as rising demand for renewable energy, technological advancements, and supportive government policies. These projections highlight the potential for biofuel additives to play a critical role in the transition towards sustainable energy solutions.

Growing Environmental Awareness

The rising awareness of environmental issues among consumers is a significant driver for the Global Biofuel Additives Market Industry. As individuals and organizations increasingly prioritize sustainability, the demand for eco-friendly fuel alternatives is surging. This shift in consumer behavior is prompting manufacturers to invest in biofuel additives that reduce emissions and enhance fuel performance. The growing preference for sustainable products is likely to influence market dynamics, encouraging companies to innovate and adapt their offerings. Consequently, this trend may lead to a more robust market presence for biofuel additives, aligning with global sustainability goals.

Rising Demand for Renewable Energy

The increasing global emphasis on renewable energy sources drives the Global Biofuel Additives Market Industry. Governments worldwide are implementing policies to reduce greenhouse gas emissions, thereby promoting biofuels as a cleaner alternative to fossil fuels. For instance, the European Union has set ambitious targets for renewable energy usage, which includes biofuels. This trend is expected to contribute to the market's growth, with projections indicating a market value of 16.7 USD Billion in 2024 and a potential increase to 41.7 USD Billion by 2035. The compound annual growth rate of 8.68% from 2025 to 2035 further underscores the urgency for sustainable energy solutions.

Expansion of Biofuel Infrastructure

The expansion of biofuel infrastructure is a pivotal factor influencing the Global Biofuel Additives Market Industry. As more biofuel production facilities and distribution networks are established, the accessibility and availability of biofuels are expected to improve. This infrastructure development is crucial for meeting the increasing demand for biofuels, particularly in regions with ambitious renewable energy targets. Enhanced logistics and supply chain capabilities can facilitate the integration of biofuels into existing fuel markets, thereby driving growth. The establishment of such infrastructure is likely to support the projected market growth, contributing to the anticipated increase in market value.

Government Incentives and Regulations

Government incentives and regulations play a crucial role in shaping the Global Biofuel Additives Market Industry. Many countries are implementing tax credits, subsidies, and mandates to encourage the use of biofuels. For instance, the Renewable Fuel Standard in the United States mandates a certain volume of renewable fuel to be blended into transportation fuels. Such regulatory frameworks not only stimulate demand for biofuel additives but also create a favorable environment for market players. As these policies become more stringent, they are expected to propel the market forward, fostering innovation and investment in biofuel technologies.

Technological Advancements in Biofuel Production

Innovations in biofuel production technologies are significantly influencing the Global Biofuel Additives Market Industry. Advances such as enzyme technology and improved fermentation processes enhance the efficiency and yield of biofuel production. For example, the development of second and third-generation biofuels, derived from non-food biomass, is gaining traction. These technologies not only optimize resource utilization but also reduce production costs, making biofuels more competitive against traditional fossil fuels. As these advancements continue to evolve, they are likely to attract investments and drive market growth, aligning with the increasing demand for sustainable energy solutions.