Top Industry Leaders in the Europe Advanced Biofuel market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Europe Advanced Biofuel industry are:

Abengoa Bioenergy, Chemtex Group, Clariant Produkte GmbH, Greenergy International Ltd. and Envien Group

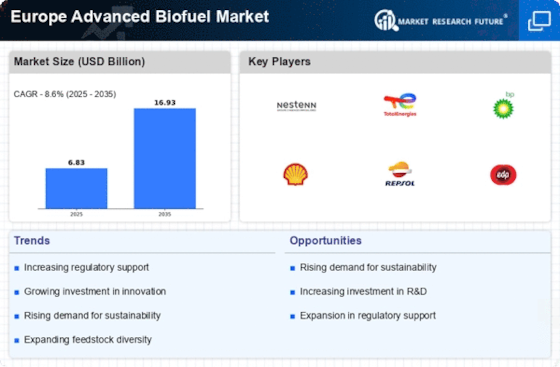

The European advanced biofuel market is a dynamic space brimming with potential, fueled by ambitious climate goals and rising demand for sustainable transportation solutions. Understanding the competitive landscape, where established players and innovative startups jostle for position, is crucial for navigating this promising arena.

Key Player Strategies:

- Technological Diversification: Leading companies like Abengoa Bioenergy, Chemtex Group, and Clariant Produkte GmbH are focusing on diversifying their technology portfolio. This involves investing in both biochemical and thermochemical conversion processes, allowing them to cater to different feedstocks and fuel types, mitigating risks and expanding their market reach.

- Strategic Partnerships and Acquisitions: Collaboration is key. Mergers and acquisitions like Neste's acquisition of Verbio enable economies of scale, knowledge sharing, and access to new feedstocks and markets. Partnerships with established fuel retailers like Shell or BP ensure efficient distribution channels and brand recognition.

- Sustainability Focus: Consumers and regulatory bodies are placing increased emphasis on the environmental footprint of biofuels. Players are focusing on feedstocks like waste oils and residues, adopting circular economy principles, and minimizing water and energy consumption to enhance their sustainability credentials.

- Regional Expansion: As the European market matures, companies are venturing beyond their home turf. Greenergy International Ltd.'s expansion into Belgium with its advanced biodiesel plant serves as an example, showcasing the pursuit of new growth opportunities across geographically diverse markets.

Factors for Market Share Analysis:

- Technology Leadership: Possession of proprietary and efficient conversion technologies gives companies a competitive edge. For instance, Clariant's Sunliquid® technology for cellulosic ethanol production offers high yields and reduced carbon footprint, attracting investor interest and potential partnerships.

- Raw Material Sourcing: Secure access to sustainable and cost-effective feedstocks is vital. Companies like UPM Biofuels leverage their existing forestry resources for efficient lignocellulose biomass production, reducing dependence on external suppliers and ensuring consistent quality.

- Governmental Incentives: Policy frameworks favoring advanced biofuels, such as blending mandates and carbon pricing schemes, significantly impact market dynamics. Players adept at navigating these complex regulations and capitalizing on available subsidies gain a significant advantage.

- Cost Competitiveness: Advanced biofuels still face price hurdles compared to fossil fuels. Companies focusing on operational efficiencies, economies of scale, and innovative financing models can bridge this gap and make their offerings more attractive to consumers and fuel retailers.

New and Emerging Trends:

- Second-generation Feedstocks: Lignocellulose, derived from agricultural residues and forestry waste, offers a sustainable and abundant feedstock option. Companies like Verbio and Stora Enso are leading the charge in developing cost-effective technologies for its conversion into advanced biofuels.

- Algae-based Biofuels: Research into algae as a potential feedstock is gaining momentum. Its rapid growth and ability to utilize non-arable land make it an attractive alternative. Companies like Neste are actively involved in pilot projects exploring the commercial viability of algae-based biofuels.

- Circular Economy Integration: Advanced biofuel production is increasingly embedded within the circular economy. Repurposing waste oils and residues for fuel production not only reduces dependence on virgin feedstocks but also minimizes waste generation, presenting a win-win for both environmental and economic sustainability.

- Digitalization and Automation: Adoption of digital technologies like artificial intelligence and automation is optimizing production processes, improving efficiency, and reducing costs. This trend paves the way for smarter operations and enhanced production scalability.

The European advanced biofuel market is characterized by intense competition, with established players vying for dominance alongside innovative startups entering the fray. Technological advancements, diversification of feedstocks, and strategic partnerships are shaping the competitive landscape. Companies that prioritize sustainability, navigate regulatory complexities effectively, and adapt to emerging trends will be best positioned to secure market share and capitalize on the potential of this dynamic and rapidly evolving market.

Latest Company Updates:

Abengoa Bioenergy:

- October 2023: Signed a €44 million loan agreement with Banco Santander to invest in its advanced bioethanol production plant in Babilafuente, Spain. (Source: Abengoa press release)

Chemtex Group:

- December 2023: Announced plans to build a €1 billion renewable diesel plant in Rotterdam, Netherlands, using its proprietary CatHTR technology. (Source: Chemtex press release)

Clariant Produkte GmbH:

- November 2023: Launched Sunliquid® cellulosic ethanol produced from wood at its Straubing, Germany, plant. (Source: Clariant press release)

Greenergy International Ltd:

- October 2023: Commissioned its advanced bioethanol plant in Teesside, UK, with a capacity of 100 million liters per year. (Source: Greenergy press release)