Advancements in Ethernet Technology

Technological advancements in Ethernet protocols are significantly influencing the Ethernet Storage Market. The introduction of faster Ethernet standards, such as 25G, 40G, and 100G, is enabling higher data transfer rates, which is crucial for modern storage solutions. These advancements facilitate improved performance and reduced latency, making Ethernet storage systems more appealing to organizations with demanding data requirements. Furthermore, the increasing adoption of Ethernet-based storage solutions is reflected in market data, indicating a steady growth rate of approximately 15% annually. This growth is driven by the need for efficient data management and the ability to support high-performance applications. As Ethernet technology continues to evolve, it is likely to further enhance the capabilities of storage systems, thereby solidifying its position in the market.

Growing Need for Scalable Storage Solutions

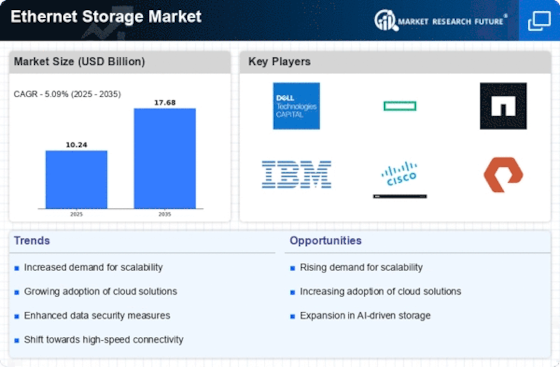

The Ethernet Storage Market is experiencing a pronounced shift towards scalable storage solutions. As organizations increasingly generate vast amounts of data, the demand for storage systems that can expand seamlessly is paramount. This trend is underscored by the fact that the data storage capacity is projected to grow exponentially, with estimates suggesting that the global data sphere could reach 175 zettabytes by 2025. Consequently, Ethernet storage systems that offer scalability are becoming essential for businesses aiming to manage their data efficiently. The ability to add storage capacity without significant downtime or disruption is a critical factor driving the adoption of Ethernet storage solutions. This trend not only enhances operational efficiency but also aligns with the evolving needs of enterprises that require flexible and adaptable storage infrastructures.

Rising Adoption of Virtualization Technologies

The Ethernet Storage Market is witnessing a surge in the adoption of virtualization technologies. As businesses increasingly implement virtualized environments, the need for efficient and reliable storage solutions becomes critical. Virtualization allows organizations to optimize their IT resources, and Ethernet storage systems are well-suited to support these environments due to their flexibility and scalability. Market data suggests that the virtualization market is expected to grow at a compound annual growth rate of around 10% over the next few years. This growth is likely to drive demand for Ethernet storage solutions that can seamlessly integrate with virtualized infrastructures. The ability to provide high availability and redundancy in storage systems is essential for organizations looking to enhance their operational resilience, making Ethernet storage a preferred choice.

Increased Focus on Data Security and Compliance

In the Ethernet Storage Market, there is an increasing emphasis on data security and compliance. As data breaches and cyber threats become more prevalent, organizations are prioritizing secure storage solutions that protect sensitive information. Ethernet storage systems are evolving to incorporate advanced security features, such as encryption and access controls, to address these concerns. Additionally, regulatory compliance requirements are driving organizations to adopt storage solutions that ensure data integrity and security. Market data indicates that The Ethernet Storage Market is projected to reach over 300 billion dollars by 2024, highlighting the critical importance of security in storage solutions. This focus on security not only enhances trust among customers but also positions Ethernet storage as a viable option for organizations seeking to safeguard their data.

Growing Demand for Cost-Effective Storage Solutions

The Ethernet Storage Market is increasingly driven by the demand for cost-effective storage solutions. Organizations are continuously seeking ways to optimize their IT budgets while ensuring efficient data management. Ethernet storage systems offer a compelling value proposition by providing high performance at a lower cost compared to traditional storage solutions. Market data suggests that the total cost of ownership for Ethernet storage systems is significantly lower, making them an attractive option for businesses of all sizes. This trend is particularly evident among small and medium-sized enterprises that require reliable storage without incurring substantial expenses. As the need for cost-effective solutions continues to rise, Ethernet storage is likely to gain further traction, appealing to organizations looking to balance performance and budget constraints.