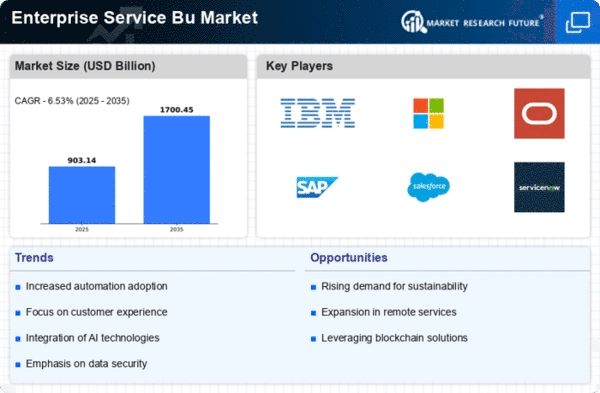

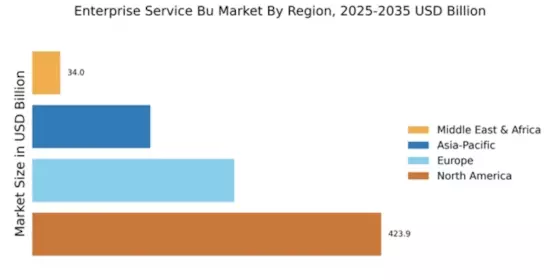

North America : Market Leader in Innovation

North America continues to lead the Enterprise Service Bu Market, holding a significant market share of 423.89 million in 2024. The region's growth is driven by rapid technological advancements, increasing demand for cloud-based solutions, and a strong regulatory framework that encourages innovation. Companies are investing heavily in digital transformation, which is further fueled by the need for enhanced operational efficiency and customer engagement.

The competitive landscape is robust, with key players like IBM, Microsoft, and Oracle dominating the market. The U.S. remains the largest contributor, supported by a strong startup ecosystem and significant investments in R&D. The presence of major tech firms and a skilled workforce positions North America as a hub for enterprise services, ensuring continued growth and innovation in the sector.

Europe : Emerging Market with Potential

Europe's Enterprise Service Bu Market is valued at 245.34 million, reflecting a growing demand for digital transformation across various sectors. The region is witnessing a shift towards cloud computing and AI-driven solutions, driven by regulatory support for data protection and digital innovation. The European Union's initiatives to enhance digital infrastructure are also catalyzing market growth, making it a key player in the global landscape.

Leading countries like Germany, the UK, and France are at the forefront, with a competitive environment featuring major players such as SAP and Salesforce. The market is characterized by a mix of established firms and innovative startups, fostering a dynamic ecosystem. As businesses increasingly adopt digital solutions, Europe is poised for significant growth in the enterprise services sector.

Asia-Pacific : Rapid Growth and Adoption

The Asia-Pacific region, with a market size of 143.55 million, is rapidly emerging as a powerhouse in the Enterprise Service Bu Market. The growth is driven by increasing investments in technology, a burgeoning middle class, and a strong push towards digitalization across industries. Governments are implementing favorable policies to support innovation and technology adoption, which is further propelling market expansion.

Countries like China, India, and Australia are leading the charge, with a competitive landscape that includes both local and international players. Companies such as Atlassian and Workday are making significant inroads, capitalizing on the region's demand for efficient enterprise solutions. As the market matures, the focus on cloud services and AI integration is expected to drive further growth in the coming years.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, valued at 34.0 million, is gradually emerging in the Enterprise Service Bu Market, driven by increasing digital transformation initiatives. The demand for enterprise services is growing as businesses seek to enhance operational efficiency and customer engagement. However, regulatory challenges and varying levels of technological infrastructure pose hurdles to rapid growth in the region.

Countries like South Africa and the UAE are leading the way, with a competitive landscape that includes both local and international players. The presence of key firms is growing, but the market remains fragmented. As governments focus on improving digital infrastructure and regulatory frameworks, the potential for growth in enterprise services is significant, albeit gradual.