Rise of Remote Work Solutions

The rise of remote work solutions is reshaping the Enterprise Service Bu Market. As organizations adapt to flexible work arrangements, there is a growing need for services that facilitate remote collaboration and productivity. Data indicates that nearly 60% of employees now work remotely at least part-time, prompting businesses to invest in tools and services that support this shift. This trend is likely to drive demand for cloud-based solutions, virtual collaboration tools, and cybersecurity services tailored for remote environments. Consequently, the Enterprise Service Bu Market is expected to experience growth as service providers develop innovative offerings to meet the evolving needs of remote workforces.

Digital Transformation Initiatives

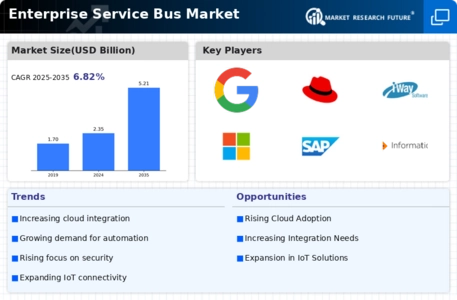

The ongoing digital transformation initiatives across various sectors appear to be a primary driver for the Enterprise Service Bu Market. Organizations are increasingly investing in technology to enhance operational efficiency and customer engagement. According to recent data, approximately 70% of companies have a digital transformation strategy in place, which is expected to drive demand for enterprise services. This shift towards digital solutions necessitates the integration of advanced technologies such as artificial intelligence and machine learning, thereby creating opportunities for service providers. The Enterprise Service Bu Market is likely to benefit from this trend as businesses seek to streamline processes and improve service delivery through innovative digital solutions.

Regulatory Compliance Requirements

Regulatory compliance requirements are becoming increasingly stringent, which significantly impacts the Enterprise Service Bu Market. Organizations are compelled to adhere to various regulations, such as data protection laws and industry-specific standards. This compliance landscape creates a demand for specialized services that can assist businesses in navigating complex regulatory frameworks. For instance, the market for compliance-related services is projected to grow at a compound annual growth rate of 12% over the next five years. As companies strive to mitigate risks associated with non-compliance, the Enterprise Service Bu Market is poised to expand, offering tailored solutions that ensure adherence to legal and regulatory mandates.

Focus on Sustainability and Green Initiatives

The focus on sustainability and green initiatives is increasingly influencing the Enterprise Service Bu Market. Organizations are recognizing the importance of adopting environmentally friendly practices, which often necessitates the integration of sustainable technologies and services. Recent studies suggest that companies prioritizing sustainability are likely to see a 20% increase in customer loyalty. This shift towards sustainability is driving demand for services that help businesses reduce their carbon footprint and implement eco-friendly solutions. As a result, the Enterprise Service Bu Market is expected to expand, with service providers offering innovative solutions that align with sustainability goals.

Advancements in Artificial Intelligence and Automation

Advancements in artificial intelligence and automation are significantly shaping the Enterprise Service Bu Market. The integration of AI technologies into business processes is enhancing efficiency and decision-making capabilities. Data shows that organizations implementing AI-driven solutions can achieve up to a 30% reduction in operational costs. This trend is prompting businesses to seek services that leverage AI and automation to optimize workflows and improve service delivery. As a result, the Enterprise Service Bu Market is likely to witness substantial growth, with service providers developing cutting-edge solutions that harness the power of AI to meet the demands of modern enterprises.